Author Camila Rocha

Introduction and History:

The fever of Korean songs and soap operas is booming in Brazil, but a new aspect of this country's culture is already beginning to emerge in Brazilian lands: to two cosmetics. This market, popularly known as K-Beauty, arrived in the country opposing the traditional American and European companies in the area. Much of the expansion of interest in these products is mainly due to two factors: the influence of K-idols – how popular Korean music singers are known, or K-pop – and their fashion styles, hair and makeup; and the viral of “Instagram”, where aspiring makeup artist of Korean descent Ellie Choi, who currently lives in Los Angeles, showed in a video your skin care routine of ten essential steps, reaching almost 20,000 “Likes” on your post, making the hashtag “Skin Glass” - “Pele de Vidro” in free translation – became a trend in the social network.

But it is not today that the Korean population is concerned with the appearance. Beautification and skin care traditions in the country date back to the Three Kingdoms of Korea (57 AC – 668 DC), with great influences of Buddhism and Confucianism. By the teachings and practices of the Confucian ideology, it was believed that beauty of the body and soul formed a unique system. Following this line of thought, a beautiful soul would only inhabit a beautiful body and vice versa. Thus, makeup was seen as a way to improve beauty not only the superficial, from external, but also the internal. For this reason, both women and men were in the habit of beautifying themselves.

Another Confucian belief is "Shi". Shi is a person's life force and was believed to be passed from parents to children, from generation to generation. The body was the representation of this family heritage and therefore it was important to preserve it in its original purity status. For such, women wore little makeup maintaining a more natural appearance that conveyed an image of simplicity, another value also worshiped in Confucianism. Heavy makeups were even seen, yet they were more used by courtesans and “morally corrupted” women. Koreans too, regardless of gender, they didn't cut their hair, and repudiated any kind of skin imperfection like blemishes, freckles, tanning and the like.

The skin tone was also relevant due to another aspect: since the aristocracy could enjoy the luxury of practicing activities that required a longer stay at home, she was not exposed to much sun, which ended up preserving a very white skin, in contrast to the skin of the peasants of the time, that was tanned and burned by the harsh sun in the fields. This fact is accentuated mainly among women. The attributes of a good Korean woman along the lines of Confucianism were that of a daughter who dedicated herself to her family, a complacent wife with her husband, and who devoted his time to taking care of his offspring, most of these activities are homemade.[1] Something different from the peasants, that in addition to all these tasks mentioned, still helped outdoors in family farming. Thereby, sporting white skin was a way to demonstrate, beyond beauty, social status and high class.

Even horsemen were recognized for their beauty and were adept at beautifying practices. Os Hwarang (화랑 - "flowering boys" in free translation) were an extraordinary group of former knights from the kingdom of Silla (57 AC – 935 DC). Members were chosen from high society families in their infancy to be trained as elite warriors and educated to the highest standards, and under a code of conduct that required them to maintain honor in all situations. As for their reputation for being gorgeous, registrars say they were very careful about their appearance, using cosmetics, fine jewelry and clothing. Habits that could be compared, moderately, to a “metro-sexual” fashion from that time. It is also reported that they would gather near streams to dance, sing and pray to nature spirits, and when returning, burned incense, creating a fine fragrance through its paths. Therefore, although military training was certainly important for the Hwarang, it would be wrong to label them only as warriors. As with the samurai in Japan, the Hwarang were military nobles and cultural ambassadors of the ruling dynasty, the closest we have to today's Idols.

After the unification of kingdoms, the kingdom of Goryeo (918-1392) was where the makeup culture flourished and reached its peak. It is said that the first king of Goryeo, TaeJo Wang Geon, ordered that the Gisaengs (parasitism) (women, normally exiled from their families or from slave families, trained to be courtesans, who served and entertained the king and the court inside the palace with conversations and various forms of art) were taught to wear proper makeup and follow a whole beautification and care label. Kingdom people differentiated their makeup paintings based on their social status. Gisaengs for example, due to your work, wore stronger makeup called bundae. On the other hand, ordinary women preferred less makeup, avoiding the use of color on the cheeks and lips.

Most of these products were made at home. To assist in skin whitening, rice powder or millet were used. On the cheekbones, rouge made of rose powder and beeswax was applied to highlight the pink cheeks, and give them a healthy look. With flower reduction, lipsticks and seed oils were made, and plants were applied to the threads and left the hair silky and hydrated. The makeup culture in the region has become a pioneer not only in the development of facial painting techniques, but also for the spread of these teachings to other regions nearby, like china.

Joseon era (1392–1910) was the period when the Confucianist practices of simplicity and modesty in makeup mentioned throughout this text were most practiced. Although the makeup trend was simpler than the Goryeo era, this did not necessarily mean that women at the time did not wear makeup, or who had no skin care. Joseon women focused on keeping their skin clean and looking natural, but well looked after.

For so much, followed a four-step care routine, always using natural ingredients. About iodine (Jodu) was a washing powder with whitening properties very popular among the court, being used to clean and exfoliate the skin. Made from soybeans, ground moyashi beans and red beans, the powder was mixed with water, that foamed due to the natural presence of saponin (bio-organic compound characterized by foaming and detergent properties), and rubbed into the skin to remove impurities and dead cells. How expensive the beans to make the jodu, lower class people used rice and wheat as substitutes. These grains are rich in vitamin B, repairing and brightening the skin. Rice water was also used to clean the skin.

Like tonic and lotion, era feito o miansu (Sorry), a liquid extracted from water-rich plants like cucumber, tomato and watermelon. Or cucumber, for example, was the favorite, for its lightening and moisturizing properties. Joseon women are said to put a slice of cucumber on their face before applying makeup, to reduce swelling and give the skin a natural glow, something similar to a current primer.

Myeonyak (Immunity) it was then used as a moisturizer, mainly in winter, to avoid cracking the skin. The mixture was made with eggs and wines and kept in a closed container. After four weeks fermenting, the cream was ready to use. It was also common to add a few drops of some oil plant such as saffron in the mixture.

Lastly, treatment masks were applied. So popular today, of various types, brands and properties, Joseon-era facial masks were made with antioxidant ingredients like honey or artemisia applied to the skin and removed after a period of rest.

These care practices, 100% natural and organic, stretched for years. The makeup industry and market did not begin to emerge until the end of the period. According to records, there were separate makeup stores in the markets, and traders visited homes to sell makeup or hair products.

In 1910, Korea was officially a Japanese colony, what, from the point of view of beauty, had two direct consequences. The first is that the Korean economy was flooded with cosmetics from Japan and the West. From this 1876, the country was forced to open its ports to Japan and enter into a bilateral trade agreement until the end of its colonization, in 1945. These foreign products were much more luxurious than homemade cosmetics on the peninsula, which ended up driving national products out of the market. The exception was “Pakgabun” (Park Gabun), the first mass-produced cosmetic by the country's cosmetics industry. It was a face powder based on foreign powders, and became a “best seller”, until you discover, in 1930, the risks of using products containing lead in the skin.

This period was also when foreign beauty standards started to be introduced in Korea. The models that printed the magazines and ads were inspired by the popular looks in Japan, what, in its turn, were inspired by the most popular patterns in western countries. Yet, these new rules and standards went against Korean traditions. During or colonislism, Japan tried its best to restrict Korean culture in all possible spheres. And with beauty standards it was no different. A good example is that the Koreans of the time had a broader and "chubby" jaw, while Japanese women had a thinner jaw and a thinner chin. Ironically, this thinner “V” jaw pattern, at first influenced by the Japanese, it is desirable to this day, being one of the most performed surgical procedures in Korea today!

With the appearance of these new patterns to the detriment of the old ones, a new dimension emerged in the country – as Modern Girls. These young women were opposed to traditionalism and Korean values and worshiped everything that came from abroad as something extremely modern and revolutionary, like or jazz, cinema and cafeterias. They decorated their hair in “Chanel cut”, wore European and American fashions and painted their faces with heavy, darker makeup, mainly on the lips. Although at first this may sound liberating, deep down that false sense of freedom was achieved only by consuming imported products, ignoring and deteriorating the country's traditional culture and turning a blind eye to all the problems that Korea was experiencing under Japanese rule. For this reason, these young people (there were also men adhering to this aspect, called Modern Boys) were severely criticized by Koreans of the older generations and by local revolutionary groups.

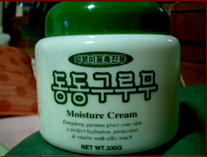

With the end of colonization, the country would go through yet another arduous period, with the Korean War (1950-1953), that devastated the country and the local economy. After the conflict, the Korean make-up and cosmetics industry started its development. In 1954 AmorePacific became the first cosmetics company to open a research laboratory. However it was very difficult to see cosmetics in rural areas in the years, 50, 60 e 70. In these places there were still street vendors who announced their arrival by beating a large drum to sell mainly Dongdong Gurumu, a moisturizing cream based on aloe vera. Even in poverty, and still with little variety of cosmetics on the market, Koreans maintained their skin care and made up their faces with bright and vibrant colors. Local trends followed western, due to the strong influence that the United States had in the region.

During the years of Park Chung-Hee's dictatorship (1962-1979), due to the ban on imported products and the strong nationalist spirit of production and consumption, the domestic market prospered, giving opportunities for new local players to emerge. As an “economic miracle”, enormously expanding the large mass of the middle class in South Korea, it brought with it the emergence of an urban bourgeoisie with its own social habit and concern for luxury and aesthetics. Besides that, as a way of rebelling the authoritarian regime imposed by Park, ways of putting on makeup and dressing became a symbol of resistance and protest. In subsequent years, the way to put on makeup saw the fusion between Korean and Western style.

Currently, care, mainly with the skin, remain very present in Korean culture. Children learn in preschool to apply sunscreen and protect their skin. Among young people and adults, the routine starts to involve many steps beyond the basic washing of the face with soap and water, diversifying between cleaning oils and gels, séruns, tonics, vitamins, facial creams and masks.

Another interesting point is that, unlike other countries where a macho culture prevails in relation to the male cosmetics niche, the number of men following a care routine in Korea is the largest in the world. Some of the blame for these appearance concerns is due to the media, that spreads strong influences: Japanese cartoon (animes), with “effeminate” men, that invaded the country's cultural scene, to actors, singers and players from the South Korean football team who have flawless, makeup-like skin. So bases, corrective and powders are considered by men as guarantees for success.

Since in society, people's first impressions are very important, flawless skin must be part of any and all plans to rise in life, be in love, or at work. An interesting story is that of Chun Do-hwan's mother, former president of South Korea (1980-1988), that would have changed the look, mainly teeth, to guarantee an exceptional destination for the child.

Several academics like Cho Joo-hyun point out that more than 50% of Koreans believe that one can “read” the character of a person on the face and that there are faces “auspiciosos” or “not auspicious”.This also connects with the idea of chemyeon (Noodle) – face social – when shameful occurrences are avoided which may cause the person or a third party to “lose their face” or, in other words, your influence, dignity or honor before your social circle. In this case, one can interpret facial features as a form of status, as in antiquity.

Another feature of the Korean market is that it is extremely diverse, both in relation to brands – there are so many that, second survey, in 2015 a new cosmetics brand per week in the country – as to the ingredients used in the compositions, ranging from the most traditional, derived from plants and herbs, even the most exotic, like snake venom and snail mucus; the latter usually used in facial masks to prevent wrinkles and smooth out dark circles.

To meet the extremely demanding demand, companies have become rich in innovation, achieving excellence in terms of technological capacity to develop and deliver new products in a short period. Doctor's offices have several scanning equipment to analyze the skin of each patient individually and prescribe the best treatments and cosmetics. Applications also came to supply a similar demand. Launched in 2013 and with more than 5 millions of user reviews to HwaHae (Reconciliation) is a Korean app that uses customer reviews to classify care by category, skin type, concern for skin and product brands. It lists the ingredients along with their EWG ratings (Environmental Working Group – Environmental Working Group), informing your users about what they are actually putting on their faces. This has not only changed the way consumers buy products, but it also influenced what companies are putting on the market.

Today, many western brands already keep an eye open to the Korean cosmetic industry, fact that became clear with the advent and popularity of this side of the globe, two famous BB creams that, before they even became popular around here in the middle of 2012, they had been fever in Korea for much longer. More recently, os cushions (a liquid foundation in the form of a compact product) have been taking up space in the west, tracking its popularity in the east.

The Current Market:

In 2018, the global beauty market was valued at $ 507.8 billion. The expectation is that it will grow to US $ 758,4 billions up 2025, according to Statista data. For a small dimension of the force that South Korea carries, the K-Beauty market has grown continuously over the years, being evaluated in the year 2018 in approximately 9,3 billions of dollars, with predictions of reaching the 21.8 billions of dollars in 2026. Asia has the largest share of the global cosmetics market with 41%, South Korea being the 9th largest world consumer market in the category. Asia also has the largest percentage of the skincare market - skincare - according to L’Oreal data, 57%, in 2019. Based on product type, the face masks segment represented the largest share of the K-beauty products market in 2018, growing at an annual rate of 11,3% and the cleaning products segment has been growing faster with a rate of 11,8% between 2019 e 2026.

Most cosmetic brands in Korea are concentrated in the hands of two large groups – the famous LG chebols and AmorePacific, in addition to other important players like Able C&C e Have&Be. The local industry has received many foreign investments. The European holding company LHVM bought a part of Clio Cosmetics, for US $ 50 millions. The negotiation valued the Korean company, reaching the figure of US $ 700 million market value, according to the Wall Street Journal. Previously, a Goldman Sachs, together with Bain Capital Private Equity had acquired a majority stake in the Carver Korea brand for US $ 307 millions, second to Reuters. These companies were especially attracted by the fact that this phenomenon still has a lot of space to be explored, commercialized and globalized.

Sales channels are well diversified among the brand's own stores, multibrand stores, shopping malls, and among other categories. Online platform sales are the most expressive, registering steady growth year after year, becoming the most popular sales channel in 2020. K-beauty marketing uses some very efficient parameters in the communication and sale of its products. Brands use certain influencers to seize opportunities on social media, following an “Instagram-first” philosophy, with social media always in mind. The products have fun packaging, Vivid colors, cartoon characters and sleek, minimalist designs. Brands often use catchy words, clear and memorable names for your products and brands, making it easier for customers to remember. It is also very common to distribute free samples of other brand lines, in a way to make customers discover new products and consume them in the future.

With all this, K-beauty brands generally spend less than six months planning and launching products, while western brands take much longer, which makes them unable to respond to new trends, or fads. The approach of “fast beauty” from korea, similarly the large fast fashion clothing chains, makes products much more accessible, compared to what's available on major retail chains. A marca Nature Republic, for example, was born exactly from this concept.

By last, having a communication model was very well used by SoKo Glam, an American K-beauty e-commerce. SoKo Glam has a content website separate from the sales channel, called The Klog, where he explains to users how to use the products according to their goals and concerns. By distinguishing SoKo Glam from The Klog, an authentic experience was created that didn’t look like the store was selling a product to anyone. Applying marketing in a simpler way and not so forced and manipulative ends up captivating the customer more.

The main export markets are still concentrated in Asian countries, the main ones being China (40%) and Hong Kong (20%) e, with smaller stakes, the Japan (4,9%) and Thailand (3%). However,, this scenario started to diversify to other regions of the globe over the years due to some threats that emerged along the way. In March 2017, commercial and political tensions began to emerge with the Chinese market, when the South Korean government authorized the United States to install the High Altitude Air Defense Terminal on national territory (THAAD, in English). The system was designed with the ability to intercept short and medium range misses.

The Chinese government began to retaliate against South Korea with trade barriers and boycotts. The measure not only impacted the entry of 19 types of beauty products, but also with online access blocks to South Korean songs and series, denied Chinese visas to Korean singers who would perform in the country; and pressured travel agencies to suspend the sale of tour packages to South Korea. Geng Shuang, spokesman for the Ministry of Foreign Affairs of China, stated, In this ocasion, that Beijing was against the system and that “would resolutely take the necessary steps to defend its interests”.

Another threat came internally, unpredictably, but with a bang, mainly on social networks: Korean women's rebellion to beauty standards imposed by an extremely patriarchal society. No last quarter of 2018, several videos appeared on Korean social media breaking their makeup, going to work or school with a clean face and cutting their hair short in a movement known as "escape from the corset" in an allusion to French clothing that restricts women in homogeneous forms. The protest followed the trends of other demonstrations in favor of women's rights such as the “Me Too” movement and more severe demands for justice against the spy cam epidemic, – videos of women filmed without their consent in sexually implicit positions or close-ups of their private parts under their clothes, unfortunately very popular practice in East Asia.

Although the Korean cosmetics industry hopes that traditional consumers will not abandon their elaborate beauty routines and products in the name of ideals, the market saw these events as a pretext for expansion in other territories, mainly not American continent. According to data from UN Comtrade, between the years 2014 e 2016, South Korean exports to the United States, its largest market in the American continent, have grown, not accumulated, 43,8%, reaching approximately US $ 474 million in 2018. Already in Brazil, third largest market in South America, exports reached their record in 2018, accounting for $ 1.7 million. The result was seen in a very positive way, after retraction in the previous year, when exports reached their lowest level at the height of the Brazilian economic crisis.

Despite the uncertainties, the cosmetics market in Brazil is seen with good eyes and opportunities, with a growing trend until 2022, according to Euromonitor data. In September 2015 the Missha brand, one of K-Beauty's biggest, was the first to enter the country, through Iguatemi Drugstore, luxury chain of beauty products. Today, she is in more than 100 outlets. In October 2017, the Commercial Division of the Embassy of the Republic of Korea (KOTRA) held in Rio de Janeiro the exhibition: “Latin America K-Beauty 2017”. The purpose of the event was to introduce Korean cosmetic companies, evaluate the potential of the Brazilian cosmetics market, analyze successful cases of Korean companies in the sector in Brazil, among other topics.

Besides that, at the beginning of the year 2018, the government of Rondônia signed a term of commitment with South Korean businessmen for the implantation of a cosmetics industry in the city of Cacoal. This partnership came naturally because of South Korea's interest in exporting technology, and the Brazilian interest in benefiting from this export, increasing your profitability and also generating more jobs.

The interest in investing in a cosmetics industry in the region is precisely due to the potential of its flora and fauna. “When it comes to cosmetics and dermocosmetics, for skin treatment, we have numerous vegetables and minerals that are found in our region. Amazonian products are already a reference in this segment and are taken to be industrialized abroad and come back to us ready. We will send out our raw material, but already as products ready to be sold beyond the borders of Rondônia, both national and international markets. We will add value to what we produce, to what we industrialize ”, says in an interview the businessman from Cacoal, Lucas Borghi.

One last important factor concerns the South Korea - Mercosur trade partnership negotiations, started in May 2018 and still pending. This would be the first free trade agreement with an Asian partner.

Korea is an important trading partner of Brazil: is the 13th largest export destination; and the 5th main country of origin of our imports. In the evaluation of the Itamaraty, the signing of an agreement between Mercosur and South Korea will contribute decisively to the strengthening of foreign trade, attracting investments, and cooperation in different sectors between Mercosur – and especially between Brazil – and the asian country. Despite this, there are analysts who call for caution and transparency in negotiations with the Asian country. “Asian countries are extremely competitive and have a very strong ability to penetrate other markets. Brazil is in the initial phase of an internationalization process and would need to support trade defense mechanisms to deal with this risk ”, evaluates Carlos Abijaodi, director of industrial development of the National Confederation of Industry (CNI), Economic Value.

Future of Cosmetics – Competitiveness and Post-Pandemic:

The COVID-19 pandemic hit global markets hard, and cosmetics were not saved. According to the “National Franchise Owners Association of Korea”, 48,8% of the cosmetics industry franchisees said that more than half (51%) of its sales have fallen since the pandemic. The AmorePacific Group should generate 1,36 trillion won in sales (17% less compared to the same period last year), e 55 billion Wons in operating profits (-73%) due to the increase in fixed costs caused by the slowdown in sales on duty-free channels.

Thereby, new trends began to emerge. The concept of Home Care has risen, with electronic devices with emission of LED and infrared lights, ultrasonic waves, massagers and the like, everything to create and provide a mini spa at home. Makeup Fixers, long-lasting and “smudge-proof” makeups have gained popularity among people who still wear makeup even under protective masks to prevent it from wearing all over the mask throughout the day. The constant use of masks also raises another concern: external and internal air in a mask does not circulate easily, causing the moisture in the breath not to be released, enabling the reproduction of bacteria and increased secretions that cause skin problems, like acne and itching. Koreans even coined the term “mask problems” (mask problems) and the market has already reacted to this new demand. According to KOTRA research (Brazil-Korea Chamber of Commerce) there was an increase of 42% of incoming new products linked as “protection and treatment for skin problems” and sales of these products registered 89% growth. Besides that, 86% of consumers started to value more the use of cleansers, than before the pandemic, in a vision to eliminate impurities, harmful bacteria and organisms like the new coronavirus.

The way to buy these products has also changed: following the trend of other markets, online sales soared. There was a growth of 25% in the figures recorded in the online cosmetics malls, in addition to around 10 billions of dollars and increased 37,5% online sales in the cosmetics sector in March compared to the same month in 2019. For such an advent, companies had to adapt their delivery and logistics services and carry out pricing and inventory management different from pre-pandemic times. A cosmetics brand Able C&C, whose main name in its portfolio Missha announced a delivery service in cooperation with the Butler Kim application. Customers who are 1,5 km from participating stores can order any cosmetic product sold at the store through the app and receive it at home on the same day, without minimum limit of value or quantity.

Faced with all these particularities that the country demonstrates for the future, industries in the sector should focus on differentials that set them apart from their competitors. An example of this is the company Tonymoly, which develops “cute” packaging aimed at young audiences. Although this demographic does not have a high purchasing power, young people are very interested in differentiated products that explore their individualism more, becoming so, a long-term investment for when this generation gets older and manages to increase its purchasing power. This audience is also becoming more aware of the ingredients used in formulas and the provenance of testing new products. The market is also geared to the demand of tourists visiting the country and to the foreign public, offering products that carry a more Korean essence. Insenfree has invested in a line of products composed of volcanic lava from the famous tourist island of Jeju. Some By Mi created a line based on Yuja, a very common citrus fruit from East Asia.

Conclusion:

The sales forecast for the South Korean market in the general spectrum is, despite the crash caused by COVID-19, positive for the coming years, with significant expansion opportunities for other world markets. Even so, companies already active in the market must exercise caution. As horizons are becoming more dynamic, new players are managing to penetrate the market easily, relying only on one or a few successful products, more than, yet they attract the attention of investors from different parts of the globe.

The demand for these products is also promising. The trend, who has already conquered the world of celebrities and fashion bloggers, if well explored, has a great chance of continuing to draw the attention of consumers, mainly from millenials and generation Z, who are always looking for news and new ways to express their identity. Brazil, despite cultural and social differences in skin care compared to Koreans, and the high tax burden that would impact the prices of imported products, is a very promising market to explore. In an interview, Camila Yu, general director of Missha in Brazil says: “Korean people are creative, innovative, considered “the Latinos” in Asia, and we will have more and more things in common with the Brazilians. ”

Individually speaking, Korean brands may not yet have as much weight as famous Western brands, but the impact of Korean innovation and technology and the ever-changing beauty concept will definitely always be relevant and serve as a benchmark for beauty and cosmetic standards around the world.

Bibliographic references:

10MAG. Introducing Hwahae. Available in: https://10mag.com/introducing-hwahae-화해-the-best-thing-to-happen-to-k-beauty-lovers-and-your-skin/. Access in: 1 set. 2020.

ABIHPEC. Sector Overview 2019. Abihpec, Brazil, v. 1, n. 9, p. 1-26, mai./2019. Available in: https://abihpec.org.br/publicacao/panorama-do-setor-2019-2/. Access in: 25 ago. 2020.

ALLURE. Viral glass skin skincare routine. Available in: https://www.allure.com/story/viral-glass-skin-skin-care-routine. Access in: 2 Apr. 2020.

ANCIENT ORIGINS. Hwarang flowering knights korea deadly warriors looked and smelled good. Available in: https://www.ancient-origins.net/history-famous-people/hwarang-flowering-knights-korea-deadly-warriors-looked-and-smelled-good-009027. Access in: 22 May. 2020.

APGROUP. Amorepacific: Our History. Available in: https://www.apgroup.com/sg/en/about-us/amorepacific/our-history/our-history-global/our-history-global.html#ourhistory. Access in: 19 May. 2020.

ASIA HOUSE ARTS. Evolution South Korean Fashion Makeup Culture. Available in: https://asiahousearts.org/evolution-south-korean-fashion-makeup-culture/. Access in: 11 May. 2020.

COMEX DO BRASIL. In Seoul, Mercosur and South Korea begin negotiating process for a free trade agreement. Available in: https://www.comexdobrasil.com/em-seul-mercosul-e-coreia-do-sul-iniciam-processo-negociador-de-um-acordo-de-livre-comercio/. Access in: 25 set. 2019.

CORESIGHT. Korean Innovation in Beauty. Available in: https://www.fungglobalretailtech.com/research/deep-dive-korean-innovation-beauty/. Access in: 27 Feb. 2020.

HALSHS. Archives. Available in: https://halshs.archives-ouvertes.fr/halshs-01211686/document. Access in: 8 jun. 2020.

ONLY UNIVERSITY. History of Makeup: from Goryeo to Joseon. Available in: https://www.hanyang.ac.kr/web/eng/spertlet_action=view_message&_newsView_WAR_newsportlet_messageId=98043&_newsView_WAR_newsportlet_sCurPage=2. Access in: 3 jun. 2020.

HERALD KOREA. Http://heraldk.com/en/2020/05/28/how-covid-19-is-affecting-the-k-beauty-industry/. Available in: http://heraldk.com/en/2020/05/28/how-covid-19-is-affecting-the-k-beauty-industry/. Access in: 6 jul. 2020.

INDEPENDENT. South Korean women destroying makeup in protest against stringent beauty standards. Available in: https://www.independent.co.uk/news/world/asia/south-korean-women-makeup-destroy-strict-beauty-standards-social-media-a8607396.html. Access in: 16 nov. 2019.

ISTOEDINHEIRO. Korean Beauty Invasion. Available in: https://www.istoedinheiro.com.br/invasao-da-beleza-coreana/ . Access in: 16 ago. 2019.

ITAMARATY. Trade between the Mercosur and the Republic of Korea. Available in: http://www.itamaraty.gov.br/pt-BR/notas-a-imprensa/18932-lancamento-das-negociacoes-de-um-acordo-de-comercio-entre-o-mercosul-e-a-republica-da-coreia. Access in: 25 set. 2019.

KOREA TIMES. Tracing history of cosmetics. Available in: http://koreatimes.co.kr/www/news/culture/2013/01/135_129776.html. Access in: 30 jul. 2020.

LLP, Allied Analytics. K-beauty Products Market by Product Type, End User, and Distribution Channel: Global Opportunity Analysis and Industry Forecast, 2019-2026. Research and Markets, Global, v. 9, n. 6, p. 1-301, out./2019. Available in: https://www.researchandmarkets.com/reports/4989430/k-beauty-products-market-by-product-type-end?utm_source=dynamic&utm_medium=BW&utm_code=54znn6&utm_campaign=1355424+-+Global+K-beauty+Products+Market:+Opportunity+Analysis+and+Industry+Forecast+(2019+to+2026)&utm_exec=jamu273bwd. Access in: 25 ago. 2020.

LOREAL. LOREAL 2019 Annual Report. Available in: https://www.loreal-finance.com/system/files/2020-03/LOREAL_2019_Annual_Report_3.pdf. Access in: 8 jan. 2020.

Maisro. DEVELOPMENT - Partnership with South Korean businessmen ensures implantation of the cosmetics industry in Cacoal. Available in: http://maisro.com.br/desenvolvimento-parceria-com-empresarios-sul-coreanos-garante-implantacao-de-industria-de-cosmeticos-em-cacoal/. Access in: 30 set. 2019.

WITH. Export kor. Available in: https://atlas.media.mit.edu/en/visualize/tree_map/hs92/export/kor/show/3304/2016/. Access in: 12 ago. 2020.

OR BALLOON. South Koreans are the men who consume the most beauty products in the world. Available in: https://oglobo.globo.com/ela/beleza/sul-coreanos-sao-os-homens-que-mais-consomem-produtos-de-beleza-no-mundo-16953944#ixzz5GwB7W94E. Access in: 27 Feb. 2020.

OBSERVATORY ECONOMIC COMPLEX. HS 92. Available in: https://oec.world/en/profile/hs92/beauty-products. Access in: 15 nov. 2019.

OHMYNEWS. Available in: http://www.ohmynews.com/NWS_Web/View/at_pg.aspx?CNTN_CD = A0001514822. Access in: 8 jun. 2020.

OZY. The Metrosexual Knights Who Defended Medieval Korea. Available in: https://www.ozy.com/true-and-stories/the-metrosexual-knights-who-defended-medieval-korea/88651/. Access in: 22 May. 2020.

PAXETV. Available in: https://www.paxetv.com/news/articleView.html?idxno = 89376. Access in: 14 ago. 2020.

PR DAILY. Marketing lessons from the South Korean beauty industry. Available in: https://www.prdaily.com/marketing-lessons-from-the-south-korean-beauty-industry/. Access in: 13 ago. 2020.

STATISTA. Value of the cosmetics market worldwide from 2018 to 2025 . Available in: https://www.statista.com/statistics/585522/global-value-cosmetics-market/. Access in: 7 jul. 2020.

ECONOMIC VALUE. Industry tries to curb agreement with South Korea. Available in: https://valor.globo.com/brasil/noticia/2020/02/12/industria-tenta-frear-acordo-com-coreia-do-sul.ghtml. Access in: 26 set. 2019.

WSJ. LVMH to Buy Minority Stake in South Korean Cosmetics Maker Clio . Available in: https://www.wsj.com/articles/lvmh-to-buy-minority-stake-in-south-korean-cosmetics-maker-clio-1469129402. Access in: 1 jul. 2020.

YOUTUBE. 100 years of Korean Beauty: the birth of modern Korean Beauty Standards . Available in: https://www.youtube.com/watch?v = QocCzJNcLxQ&t=324s. Access in: 13 ago. 2020.

YOUTUBE. 4 Ancient Korean Beauty Secrets for glowing skin. Available in: https://www.youtube.com/watch?v = IEyymL7TUrM. Access in: 21 May.2020

Author Camila Rocha – Paulista de 24 years, one step closer to earning your bachelor's degree in International Relations. Halfway through your studies, ended up falling into the fascinating black hole that is South Korea. Dedicated to learning more about the country, joined NENA - Center for Asian Studies and Business in 2018 and did an exchange for Korea University in 2019. Always yearning for new teachings, she hopes one day that everyone can see the Asian continent with an optimistic and promising look