O Japão apresentou crescimento econômico em 2021 se tem uma ampliação do PIB japonês em 2,4% (IFM, 2022), revertendo o resultado negativo de 2020. E nos últimos 5 anos, apesar das quedas em 2020 e 2021 influenciados pela COVID-19, o índice da bolsa de valores de Tóquio (Nikkei 225) obteve um aumento de 48,5% (RIVAS, 2022). Diferente no Brasil, o índice da bolsa de valores brasileira (Ibovespa) sofre uma redução de 3,6% no mesmo período.

O Japão é a 3ª maior economia do mundo, com um PIB de mais de 5,2 trilhões de dólares em 2021 (MINISTÉRIO DAS RELAÇÕES EXTERIORES, 2021). E a economia do país é muito estável, mesmo com os grandes efeitos da pandemia no cenário mundial, o Japão tem um crescimento previsto do seu PIB de 3,2% em 2022 (INTERNATIONAL FUND MONETARY, 2022).

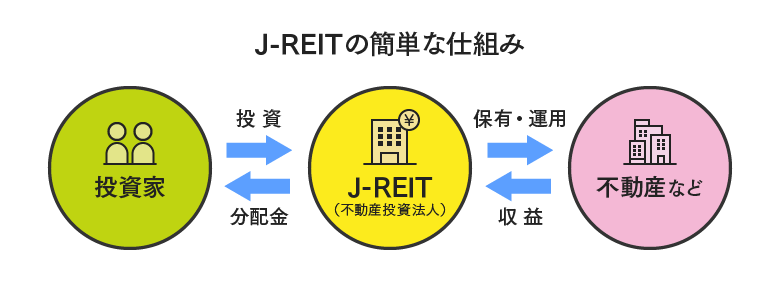

Este ambiente torna o Japão bastante atrativo para investimentos e uns dos principais destaques no país são os fundos imobiliários ou Real Estate Investment Trust (J-REITs) que fazem parte do mercado de ações chamados no Brasil de Fundos de Investimento Imobiliário (FIIs). Os fundos imobiliários são uma forma mais simples de ter um investimento em um imóvel, mas sem precisar comprar um. É tornar-se dono de um “pedacinho” daquele imóvel através de um fundo.

Para aproveitar as oportunidades é necessário abrir uma conta em uma corretora de valores japonesa. Por exemplo, pode-se abrir uma conta na Rakuten e com valor perto de 3 mil ienes, já se consegue investir nos fundos imobiliários no mercado de ações japonês (RAKUTEN, 2022). Os J-REITs são cotas que são negociadas na bolsa de valores de Tóquio (TYO) e grande parte dessas propriedades estão concentradas no grande centro de Tóquio ou no exterior. Tanto no Brasil como no mercado japonês com valor aproximado de 100 reais já se consegue investir nos fundos (RAKUTEN, 2022), mas por que se deve investir em específicos J-REITs e não em alguns fundos imobiliários do mercado brasileiro?

Entre março de 2020 até 2021, o índice J-REITs da Bolsa de Valores de Tóquio superou o Topix, subindo mais de 25% (GOVERNMENT PENSION INVESTMENT FUND, 2021). Diferente dos FIIs no Brasil que em 2020 tem um tombo de mais de 10% e fecharam em 2021 com uma queda de 2,29% (WILTGEN, 2022). Então, o J-REITs pagam mais dividendos do que as cotas das empresas e são menos variáveis do que grande parte das ações na bolsa de valores de Tóquio (TYO), sendo uma ótima alternativa de diversificar e iniciar sua carteira de investimentos na bolsa de valores de Tóquio (PIMENTEL, 2022). Basicamente no funcionamento dos J-REITs os investidores compram cotas dos fundos imobiliários (J-REITs) em sua maioria sendo semestralmente, ou seja, a cada 6 meses, recebem parte dos lucros dos fundos acumulados. E esses fundos adquirem ativos de propriedades e recebem os aluguéis desses imóveis que são distribuídos também pelos dividendos.

Há mais de 60 J-REITs no mercado japonês, mas alguns destacam-se, como o Nippon Building com capitalização de mercado mais de 1 trilhão de ienes, Japan Real Estate com capitalização de mercado mais de 845 bilhões de ienes e Nomura Master com capitalização de mercado mais de 730 bilhões de ienes (JAPAN REIT, 2022). O Nippon Building é uma imobiliária localizada em Tokyo e o fundo foi listado na bolsa de valores do país em 10 de setembro de 2001 com capital inicial de cerca de 50 bilhões de ienes (NIPPON BUILDING FUND, 2022).

Comparando umas das maiores capitalizações de mercado japonês, o Nippon Building com o brasileiro Fundo Imobiliário Kinea Índice de Preços (KNIP11), vemos que este retraiu em quase 10% no último ano, enquanto o Nippon aumentou perto de 1% (THOMSON REUTERS, 2022). E observando o desempenho dos dividendos, enquanto o acumulado de 31/01/2022 foi de 1,31% da Kinea Índices Preços Fundo de Investimento Imobiliário (KNIP11) (INFOMONEY, 2022), a Nippon Building tem um índice maior de 3,5% (BLOOMBERG, 2022).

Nippon Building (8951T) X Fundo Imobiliário Kinea Índice de Preços (KNIP11.SA)

Dados até 01/03/2022.

Fonte: Thomson Reuters.

O gráfico evidencia que a rentabilidade acumulada no último ano foi maior no Nippon Building do que no Kinea Índices Preços Fundo de Investimento Imobiliário (KNIP11). Esse é apenas umas das possibilidades de investimento no Japão, que ocupa a segunda colocação no mercado mundial de J-REITs com 9,8%, fica atrás apenas dos EUA (PIMENTEL, 2020).

Em termos de desempenho, como foi mostrado, alguns J-REITs tiveram retornos acumulados atraentes em curto prazo, proporcionaram diversificação e renda baseada em dividendos que muitas vezes são mais altos do que se pode obter com outros investimentos. Claro que não são todos os fundos que estão tendo alto retorno, tanto no mercado japonês ou brasileiro a renda variável apresenta volatilidade. Porém, alguns fundos específicos continuam dando alta rentabilidade e dividendos em 2022, como é o caso do Nippon Building. Então, antes de começar a investir, recomenda-se que o leitor conheça mais sobre o mercado de fundo imobiliário do Japão. a fim de escolher a melhor fundo para alocar seu dinheiro.

Logo, J-REIT é particularmente preferido para fundos de investimento pela sua liquidez ou acessibilidade que adotam estratégias de aquisição-crescimento baseado em políticas e critérios de investimento específicos (NAKAJIMA-MAGEN, 2021). Cada fundo tem sua peculiaridade e certas exigências legais (como a exigência de fazer distribuições anuais acima de 90% dos lucros distribuíveis) que quando satisfeitas os J-REITs estão isentos do imposto de renda corporativo com relação aos dividendos que distribuem para os investidores (WITHUM, 2020).

Por fim, as oportunidades estão abertas, pois segundo Nanette Jacobson, diretora de Renda Fixa na Wellington Management, durante evento online em 2022, na InfoMoney em parceria com a XP Investimentos. “As ações japonesas estão com um valuation menor do que as ações de mercados desenvolvidos e há espaço para continuarem crescendo” (RIVAS, 2022).

Bibliografia

BLOOMBERG. Nippon Building Fund Inc, Nova York, 2022. Disponivel em: <https://www.bloomberg.com/quote/8951:JP>. Acesso em: 1 Março 2022.

GOOGLE FINANCE. Kinea Indices Precos Fundo de Investimento Imobiliario, 9 Fevereiro 2022. Disponivel em: <https://www.google.com/finance/quote/KNIP11:BVMF?sa=X&ved=2ahUKEwjo7PLlnvP1AhX1ILkGHSDoCHAQ3ecFegQIGRAc&window=1Y>. Acesso em: 9 Fevereiro 2022.

GOOGLE FINANCE. Nippon Building Fund Inc., 9 Fevereiro 2022. Disponivel em: <https://www.google.com/finance/quote/8951:TYO?sa=X&ved=2ahUKEwi545aLnvP1AhUmHbkGHRYVBF4Q3ecFegQIERAe&window=1Y>. Acesso em: 9 Fevereiro 2022.

GOVERNMENT PENSION INVESTMENT FUND. Integrated risk management between J-REITs and traditional assets, Japão, 24 Agosto 2021. 4-5. Disponivel em: <https://www.gpif.go.jp/investment/20210910_workingpaper.pdf>. Acesso em: 9 Fevereiro 2022.

IFM. Real GDP growth (Annual percent change). Washington, D.C.: [s.n.], 2022. Disponivel em: <https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/JPN>. Acesso em: 28 Março 2022.

INFOMONEY. Fundos Imobiliários KNIP11, 25 Fevereiro 2022. Disponivel em: <https://www.infomoney.com.br/cotacoes/b3/fii/fundos-imobiliarios-knip11/>. Acesso em: 1 Março 2022.

INTERNATIONAL FUND MONETARY. Real GDP growth, USA, 2022. Disponivel em: <https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/JPN/BRA>. Acesso em: 7 Fevereiro 2022.

JAPAN REIT. List of Yields, 9 Fevereiro 2022. Disponivel em: <https://en.japan-reit.com/list/rimawari/>. Acesso em: 9 Fevereiro 2022.

MINISTÉRIO DAS RELAÇÕES EXTERIORES. As 15 maiores economias do mundo, Brasília, 11 Novembro 2021. Disponivel em: <https://www.gov.br/funag/pt-br/ipri/publicacoes/estatisticas/as-15-maiores-economias-do-mundo>. Acesso em: 7 Fevereiro 2022.

NAKAJIMA-MAGEN, Z. J-REITS (Japanese Real Estate Investment Trusts), Japão, 31 Março 2021. Disponivel em: <https://www.linkedin.com/pulse/j-reits-japanese-real-estate-investment-trusts-ziv-nakajima-magen/>. Acesso em: 25 Fevereiro 2022.

NIPPON BUILDING FUND. Corporate Overview – Profile and History., Tokyo, 2022. Disponivel em: <https://www.nbf-m.com/nbf_e/profile/company/outline.html>. Acesso em: 25 Fevereiro 2022.

PIMENTEL, M. S. J-REITs: Japanese Real Estate Investment Trusts, 2020. Disponivel em: <https://investidornojapao.com/j-reits-japanese-real-estate-investment-trusts/>. Acesso em: 9 Fevereiro 2022.

PIMENTEL, M. S. Invista em Fundos Imobiliários no Japão, 2022. Disponivel em: <https://investidornojapao.com/invista-em-fundos-imobiliarios-no-japao-j-reits-curso-presencial/#:~:text=Os%20REITs%2C%20em%20m%C3%A9dia%2C%20pagam,de%20se%20investir%20em%20im%C3%B3veis.>. Acesso em: 25 Fevereiro 2022.

PIMENTEL, M. S. Os 10 REITs com os maiores retornos em dividendos do Japão, 2022. Disponivel em: <https://investidornojapao.com/os-10-reits-com-os-maiores-retornos-em-dividendos-do-japao/#:~:text=Os%20REITS%20no%20Jap%C3%A3o%20pagam,listadas%20na%20Bolsa%20de%20Valores.>. Acesso em: 1 Março 2022.

RAKUTEN. Investment Trust Super Search, Japão, 2022. Disponivel em: <https://www.rakuten-sec.co.jp/web/fund/find/search/result.html>. Acesso em: 7 Fevereiro 2022.

RAKUTEN. Investment Trust Super Search, Tokyo, 2022. Disponivel em: <https://www.rakuten-sec.co.jp/web/fund/find/search/result.html>. Acesso em: 2 Março 2022.

RIVAS, K. Japão, China ou Europa? Saiba que outros mercados oferecem oportunidades para diversificar os investimentos, São Paulo, 21 Janeiro 2022. Disponivel em: <https://www.infomoney.com.br/onde-investir/japao-china-ou-europa-saiba-que-outros-mercados-oferecem-oportunidades-para-diversificar-os-investimentos/>. Acesso em: 7 Fevereiro 2022.

RIVAS, K. Mercado esquecido pelos investidores, Japão é aposta da gestora americana Wellington para 2022, 20 Janeiro 2022. Disponivel em: <https://www.infomoney.com.br/onde-investir/mercado-esquecido-pelos-investidores-japao-e-aposta-da-gestora-americana-wellington-para-2022/>. Acesso em: 23 Fevereiro 2022.

THOMSON REUTERS. Nippon Building Fund Inc.8951.T, 2022. Disponivel em: <https://www.reuters.com/companies/8951.T/charts>. Acesso em: 1 Março 2022.

URABE, E. Japanese REITs Better Than Traditional Assets, GPIF Report Says, 13 Setembro 2021. Disponivel em: <https://www.bloomberg.com/news/articles/2021-09-13/japanese-reits-better-than-traditional-assets-gpif-report-says>. Acesso em: 10 Fevereiro 2022.

WILTGEN, J. Fundos de papel dominam o ranking dos melhores fundos imobiliários de 2021; conheça também os piores FII do ano, 2 Janeiro 2022. Disponivel em: <https://www.seudinheiro.com/2022/bolsa-dolar/fundos-de-papel-dominam-o-ranking-dos-melhores-fundos-imobiliarios-de-2021/>. Acesso em: 9 Fevereiro 2022.

WITHUM. REITs Come Out Ahead in Light of TCJA, 6 Janeiro 2020. Disponivel em: <https://www.withum.com/resources/reits-come-out-ahead-in-light-of-tcja/>. Acesso em: 10 Fevereiro 2022.

Artigo elaborado por Alison Cordeiro Sousa: estudante do curso de Relações Internacionais e pesquisador do Núcleo de Estudos em Negócios Asiáticos (NENA).

Concentrando dois terços da população global, nele estão 3 dos 10 maiores PIBs do planeta: China, 2º; Japão, 3º; e Índia, 5º. De caráter multidisciplinar, o núcleo tem por objetivo difundir o conhecimento sobre a Ásia no Brasil, sobretudo na esfera acadêmica, empresarial e entre o público interessado.