1 INTRODUÇÃO

República da China (RDC) ou Taiwan, é uma ilha localizada a 200 km da República Popular da China (RPC), com governo independente e sendo reconhecida como um país por 20 nações no mundo (BARBOSA, JUNIOR e SATUR, 2016). A RPC, observa a ilha, como uma província rebelde que faz parte de seu território (VLADIMIR IVANOV, 2022). A ocupação da Rússia na Ucrânia, em 24 de fevereiro de 2022, com tacit support da China à invasão russa, sustentou no sistema internacional, especulações sobre as intenções de Pequim com Taiwan (YEUNG, GAN e JIANG, 2022). Por exemplo, Tadeu (2022) afirma que a abstenção da China na votação no conselho de segurança da Organizações das Nações Unidas (ONU) na resolução de crítica ao país russo, levantou preocupações no mundo sobre a possibilidade de a China lançar um ataque a ilha.

Já que também é verificado que ao longo das últimas décadas, os Estados Unidos estão tentando aumentar a participação de Taiwan no sistema internacional em comércio e segurança (WENZHAO, 2017). E a China ver o ato como uma ação de energizar mais as tensões com Taiwan, em ameaçar a paz e a estabilidade do Estreito da ilha, possivelmente sendo necessário utilizar a força para controlar Taiwan (HERNÁNDEZ, 2016; TRENT, 2020).

Ou seja, os chineses que afirmam a existência de uma única China na região, miram esse ato como uma infração à sua soberania. Por outro lado, o congresso americano honra o seu compromisso de apoiar a democracia vibrante de Taiwan.

Portanto, segundo Hsu, Hsu e He (2021), a complexidade das relações entre os dois lados do Estreito de Taiwan é incapaz de retratar apenas de uma perspectiva política ou de segurança, assim podendo também ter espaço para uma abordagem econômica, para a melhor compreensão dos níveis de tensões entre os países. Já que o comércio exterior dos países está fortemente interligado, com a China representando mais de $82 bilhões, Estados Unidos perto de $40 bilhões do comércio de Taiwan (MA, 2022).

Como o comércio exterior e a segurança dos países estão muito associados, pode-se pensar que as métricas, como a correlação linear de Pearson, regressão logística, econometria espacial, auxiliam na amostragem da pesquisa, para averiguar estatisticamente, se com as altas tensões de ambos os lados do Estreito, pode estar aumentando ou diminuindo, o percentual dos investimentos do comércio chinês em relação ao mercado taiwanês (PIETRAFESA e SILVA, 2019). E compreende-se, de forma geral, que os chineses estão sendo bem mais hostis com a ilha, tendo em vista a maior ocidentalização de Taiwan (TIAN e LEE, 2020). Fazendo com que, em resposta, também o percentual de investimentos da ilha na China Continental seja reduzido (YEUNG, GAN e JIANG, 2022).

A correlação linear e o modelo logístico, mostram que Taiwan pode ser agressivo, mesmo em cooperativa chinesa (PIETRAFESA e SILVA, 2019). Alguns estudos como de Christensen (2006), ilustra que o Taiwan é a questão mais sensível nas relações sino-americanas. E os estudos de, Wang (2013), Huang (2017) e Rato (2020), se preocupam em relatar o desenvolvimento histórico dos países, sem ter uma profunda análise estatística. Assim, se pode ter a possibilidade para uma abordagem estatística, e ter variáveis que possam esclarecer, uma parte, da sensibilidade política da ilha na relação entre China e Estados Unidos.

Já a análise econométrica espacial, é relevante, pois é visto o quanto que a maior afinidade de Taiwan com os Estados Unidos, as estratégias de investimentos ou de comércio da ilha com os chineses são alteradas. Basicamente, o investimento de Taiwan na China e o risco de business ou mercado estão negativamente correlacionados, indicando que o investimento de Taiwan na China foi afetado pelas relações econômicas gerais entre os dois países, com fortes tensões, especialmente em Taiwan nos últimos anos (GOMES, LIMA, et al., 2019). E isso também impacta as estratégias de negócios para as empresas localizadas na ilha.

Dessa forma, o objetivo deste projeto de pesquisa é pesquisar e avaliar os níveis das tensões entre Estados Unidos, China e Taiwan entre 2012 e 2022, as razões do aumento das tensões entre esses períodos, abordando às relações de segurança e relações econômicas.

Por fim, o projeto de pesquisa visa pesquisar os seguintes temas: as relações econômicas de China, Taiwan e Estados Unidos. Com o objetivo de verificar o quanto que o governo chinês está disposto a utilizar a força política ou econômica para a reunificação de ambos os lados do Estreito de Taiwan e a postura da política dos americanos com os chineses e taiwaneses.

2 Balanço da Economia Internacional entre China, Estados Unidos e Taiwan

Este capítulo discorrerá sobre a postura do comércio exterior de Taiwan e efeitos econômicos a não adesão ao Acordo ASEAN que pode ocasionar com a economia ilha. Depois disso, visto que a China está disposta a ser hostil com a ilha para alcançar seu sonho de regeneração nacional, é realizada uma análise econométrica espacial para averiguar o quanto que os investimentos dos taiwaneses no comércio chinês vêm diminuindo e sendo uma possível resposta pelas agressões chinesas que Taiwan vem sofrendo.

2.1 Comércio Exterior de Taiwan, dependência de China ou Estados Unidos e efeitos com o Acordo Asean sob perspectiva da política comercial de Krugman

Como visto que o estudo não pode ter somente uma única abordagem política, para a compreensão das tensões entre China, Estados Unidos e Taiwan. Portanto, Hsu, Hsu e He (2021) afirmam que a complexidade das relações entre os dois lados do Estreito de Taiwan é incapaz de retratar apenas de uma perspectiva política ou de segurança, assim podendo ter espaço para uma abordagem econômica internacional.

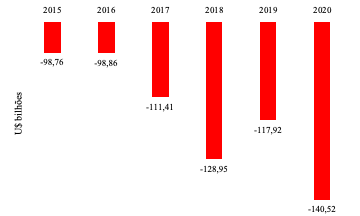

Inicialmente, o comércio internacional de Taiwan está fortemente interligado com Estados Unidos e China, constituindo-se essencialmente de bens industriais. A China representa mais de $82 bilhões, Estados Unidos perto de $40 bilhões do comércio exterior de Taiwan (MA, 2022). De 2013 até 2021, China representa 24% e Estados Unidos com 12% do total trade em relação à Taiwan (BOREAU OF TRADE, 2022). Porém, entre 2015 até 2020, a China registrou um déficit comercial de mais de 140 bilhões de dólares com Taiwan (FIGURA 5).

Figura 5: Balanço comercial entre a China e Taiwan de 2015 a 2020 (em bilhões de dólares)

Fonte: (MA, 2021).

Isso mostra o quanto que o comércio da ilha taiwanesa está ligado com umas das principais economias do mundo. E baseado em dados da UN Comtrade, 62% do volume total do comércio dos Estados Unidos com Taiwan veio de importações do Estado insular em 2021. A maioria destes bens insere-se no setor de TI e eletrônico, com empresas como a Apple, Qualcomm e NVIDIA a dependerem de chips fabricados nas fundições de semicondutores de grande escala de Taiwan (ZANDT, 2022). Esse fato também evidencia o quanto que também o comércio de Taiwan está associado fortemente ao americano, mesmo adotando uma política de produção de bens industriais em seu território (KING, 2022).

A fala “de produzir para os americanos”, sobre State of Union de Joe Biden abordando o mercado internacional, no início de março de 2022, no Congresso Nacional (U.S. DEPARTMENT OF STATE, 2022). Mostra complicações nas relações com China e Taiwan, visto que grande parte da indústria americana se encontra em ambos os continentes. Então, é visto pelo discurso de Biden, que o governo americano pretende focar em friendshoring, aos poucos, para levar a produção para países que estão alinhados com suas políticas e produzir na própria região. Por exemplo, Macy’s anunciou que suas produções vão ser fora da China (BHATTACHARYYA, 2018). Ou a Intel tem um planejamento de gastar $20 bilhões em centros de fabricação de chips nos arredores de Columbus, com isso a companhia espera tornar o maior local de fabricação de semicondutores do mundo, ultrapassando Taiwan (KING, 2022). Portanto, o comércio exterior entre os países será afetado.

Outro fator no comercio internacional essencialmente entre, China e Taiwan, são as tarifas de importações. O Acordo de “ASEAN + 1” ou ASEAN (Association of Southeast Asian Nations), assinado em 1 de janeiro do 2010, eliminaria ou zeraria as tarifas de importações dos países do Acordo para a China, em mais de 90% dos produtos comercializados (FEDDERSEN, 2020). Além da discussão a possiblidade da “ASEAN + 3”, ou seja, de incorporação do Japão e Coreia do Sul nessa zona de livre comércio, Taiwan continua fora da lista do Acordo. Segundo Chou (2010):

The ASEAN + 1 and ASEAN + 3 arrangements prevent Taiwan’s businesses from competing effectively in the Asian market, causing its eventual marginalization in the region. In 2010, while most ASEAN goods gain tariff-free access to the Chinese market, most Taiwanese imports into China will still be subject to a 6–14% tariff. Consequently, Taiwanese businesses will be forced to leave China and invest elsewhere to avoid this disadvantage. If allowed to snowball, this problem would hollow out Taiwanese industries and severely damage Taiwan’s competitiveness. With decreased capacity, Taiwan will no longer play an important role in the Asian economy, and will appear as “the wallflower in China’s dance with regional trade partners.” Making matters worse, South Korea, one of the “Plus Three” countries, also has an export-heavy economy and has become Taiwan’s biggest competitor in recent years. Thus, if Taiwan cannot effectively reduce its costs, its role in the Asian economy may be slowly replaced by an ambitious South Korea, which enjoys open access to China and ASEAN member countries. On the other hand, if Taiwan does successfully negotiate the ECFA and therefore levels the playing field, studies show that foreign investments in Taiwan can increase from 29 –42%. Should Taiwan also manage to negotiate free trade arrangements with ASEAN, its foreign and domestic investments are projected to increase another 23–37% (CHOU, 2010).

Em outras palavras, Chou (2010), mostra que o Acordo é desfavorável economicamente para Taiwan, pois o país não irá participar da zona de livre comércio, e não tendo reduções do preço de importações de mercadorias. Ou seja, com a não redução das tarifas de importações da ilha e com possíveis aumentos, se tem efeitos em cadeia para a economia e comércio de Taiwan (KRUGMAN, OBSTFELD e MELITZ, 2015).

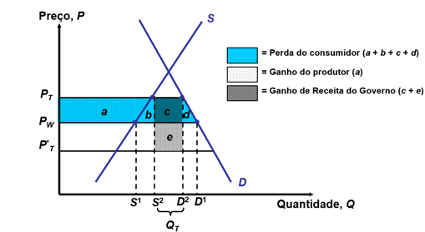

Por exemplo, como Taiwan não teria o benéfico da zona de livre comércio, em zerar suas tarifas de importações. Segundo Krugman (2015), Taiwan sofreria com possível aumentos do preço de diversas mercadorias, elevação dos custos de produção, maior perda de bem-estar dos consumidores taiwaneses, aumento de arrecadação de impostos aduaneiros, aceleração de proteção para produtores taiwaneses de semicondutores, por exemplo. Porém, maior perda da competitividade de exportadores de diversas mercadorias à Taiwan (FIGURA 6).

Figura 6: Os custos e benefícios para diferentes grupos podem ser representados como a soma das cinco áreas

Fonte: (KRUGMAN, OBSTFELD e MELITZ, 2015).

Então, as áreas dos dois triângulos e medem a perda para a nação como um todo (perda de eficiência) e a área do retângulo ( ) mede um ganho compensatório (ganho de termos de troca). A perda de eficiência surge, porque uma tarifa distorce os incentivos ao consumo e à produção (KRUGMAN, OBSTFELD e MELITZ, 2015). Os produtores e consumidores agem como se as importações fossem mais caras do que realmente são. O triângulo é a perda de distorção da produção e o triângulo é a perda de distorção do consumo (KRUGMAN, OBSTFELD e MELITZ, 2015). O ganho de termos de troca surge porque uma tarifa baixa os preços de exportação para o estrangeiro.

Resumidamente, com o a não adesão de Taiwan na zona de livre comércio da ASEAN, a tarifa eleva o preço nacional de para , mas diminui o preço estrangeiro de exportação de para . Consequentemente, a produção nacional sofre uma aceleração de para , enquanto o consumo retrai de para . Os custos e benefícios para diferentes grupos podem ser expressos como a soma das áreas de cinco regiões, denominadas (KRUGMAN, OBSTFELD e MELITZ, 2015).

Um modo simples de pensar esses ganhos e perdas para Taiwan é a seguinte, segundo Krugman, Obstfeld e Melitz (2015):

“Os triângulos simbolizam a perda de eficiência que surge, pois, uma tarifa aduaneira distorce incentivos para consumir e produzir, enquanto o retângulo representa os termos de ganho do comércio que surgem porque a tarifa aduaneira diminui os preços de exportação estrangeira. O ganho depende da capacidade da imposição de tarifa aduaneira do país para diminuir os preços da exportação estrangeira. Se o país não pode afetar os preços mundiais, a região e, que representa os termos de ganho do comércio, desaparece e fica claro que a tarifa aduaneira reduz o bem-estar” (KRUGMAN, OBSTFELD e MELITZ, 2015).

Ou seja, a tarifa aduaneira aumenta o preço em Doméstica, enquanto diminui o preço em Estrangeira. Quando um país é de menor expressão no PIB mundial, como Taiwan, o preço das importações das mercadorias industriais ou agrícolas irão aumentar ( para ) e a quantidade demandada das importações diminui ( para ).

A tarifa aduaneira eleva o preço de uma mercadoria no país importador e reduz o preço no país exportador. Como resultado, os consumidores perdem no país importador e ganham no país exportador. Em outros palavras, o preço irá aumentar para o consumidor com Taiwan não tendo suas importações zeradas, por não participarem do ASEAN e terá uma redução de consumo e aumento da produção nacional. Por isso, os produtores tendem a ganhar mais no país importador do que no exportador. Além disso, o governa ganha receita com a imposição de uma tarifa aduaneira. O apontamento de Krugman, Obstfeld e Melitz (2015), confirma essa hipótese:

“A tarifa aduaneira distorce os incentivos tanto para os produtores quanto para os consumidores induzindo‑os a agir como se as importações fossem mais caras do que elas realmente são. O custo de uma unidade adicional de consumo para a economia é o preço de uma unidade adicional de importação, ainda porque a tarifa aduaneira aumenta o preço nacional acima do preço mundial, os consumidores reduzem seu consumo ao ponto no qual a unidade marginal rende‑lhes bem estar igual ao preço nacional da tarifa incluída. Isso significa que o valor de uma unidade de produção adicional para a economia é o preço da unidade de importação que ele economiza, ainda que os produtores nacionais expandam a produção até o ponto no qual o custo marginal seja igual ao preço da tarifa incluída. Portanto, a economia produz nacionalmente unidades adicionais da mercadoria que poderia comprar de forma mais barata no exterior” (KRUGMAN, OBSTFELD e MELITZ, 2015).

Logo, Taiwan, sofrerá de excedente do produtor e na receita do governo, tendo desincentivos para o consumidor e maior perca de competitividade das exportações e de inserções no mercado internacional (KRUGMAN, OBSTFELD e MELITZ, 2015) (TABELA 9). O que mostra, também que o Acordo de ASEAN pode tentar reduzir, cada vez mais, a participação de Taiwan nos assuntos internacionais.

Tabela 9: Resumo dos efeitos de políticas de comércio internacional

| Política | Tarifa Importação (aduaneira) | Subsídio de Exportação | Quota de Importação | Restrição de Exportação Voluntária |

| Excedente do Produtor | Aumenta | Aumenta | Aumenta | Aumenta |

| Excedente do Consumidor | Reduz | Reduz | Reduz | Reduz |

| Receita do Governo | Aumenta | Reduz (gastos do governo ampliam) | Nenhuma Mudança (aluga para proprietários de licença | Nenhuma Mudança (aluga para estrangeiros) |

| Bem – Estar | (Ambíguo) diminui para país pequeno | Reduz | (Ambíguo) diminui para país pequeno | Reduz |

Fonte: (KRUGMAN, OBSTFELD e MELITZ, 2015).

Por fim, mesmo os Estados Unidos estarem inserindo Taiwan no comércio ou nos assuntos internacionais. É visto que, nas próximas décadas, a ilha poderá não ter um comércio tão interligado com Estados Unidos, pelo investimento dos americanos em produção de chips semicondutores em Columbus (KING, 2022). E da China tentar, cada vez mais, isolar os taiwaneses do comércio regional e do resto do mundo (FEDDERSEN, 2020). E uma das possíveis respostas de Taiwan é também de tentar diminuir os seus investimentos na China Continental, ou seja, é visto que baixos investimentos taiwaneses para o comércio dos chineses, por ter uma correlação não muito significativa de Moran em algumas regiões.

2.2 Modelagem econométrica espacial e a relação entre o comércio dos chineses e taiwaneses

Como foi realizado o teste da matriz de correlação e da probabilidade dicotômicas do modelo logístico, a atitude mais agressiva de Xi Jinping com os taiwaneses, está ligado ao crescimento econômico do país e participação (%) da China na economia da ilha (TABELA 4) (PIETRAFESA e SILVA, 2019). Visto que a China quer ampliar a dependência de Taiwan no comércio chinês, a partir disso, os valores logísticos encontrados, mostram o quanto que os taiwaneses podem ser hostis com os chineses (TABELA 5). Portanto, a chance da ação diplomática de Taiwan ser hostil quando a diplomacia chinesa é de 53,10 vezes maior do que a chance da ação de Taiwan ser hostil quando a atitude chinesa é mais cooperativa (PIETRAFESA e SILVA, 2019). Como mostra a análise, se Xi Jinping continuar pressionando o governo de Taiwan por ações hostis, é mais provável que a resposta não esteja na direção que a China gostaria que estivesse.

Então, com esses dados, agora uma outra medição importante é a realização de modelagem econométrica, para averiguar o quanto que os taiwaneses estão mudando a sua postura comercial e de investimentos, nas últimas duas décadas, com os chineses, já que também, essencialmente no governo de Tsai Ing-wen, vem tendo uma maior afinidade pelo Ocidente (TIAN e LEE, 2020).

O índice de Moran, auxilia para identificar os fatores de impacto da estratégia dos investimentos de Taiwan na China Continental nos últimos 20 anos, e os valores mostram características de distribuição desigual nas regiões leste, central e ocidental.

Em primeiro lugar, Moran’s I é aplicado para determinar se existe ou não heterogeneidade espacial. Moran’s I tem uma vantagem significativa no estudo da relevância das variáveis espaciais. Reflete o grau de semelhança entre as propriedades dos valores dos atributos unitários das regiões adjacentes para analisar o coeficiente de autocorrelação espacial entre as variáveis (GOMES, LIMA, et al., 2019).

Em geral, o critério de seleção é I se situe na gama -1 ≤ I ≤ 1 (LUZARDO, FILHO e RUBIM, 2017). Quando o comportamento econômico das duas regiões está positivamente correlacionado, I é positivo. Quando o comportamento está negativamente correlacionado, I é negativo. Se I for 0, as economias destas duas regiões são independentes. A utilização dos índices globais e locais de Moran pode revelar a correlação espacial da região global e da área circundante (BALTAGI, 2009).

O teste da correlação espacial, baseia-se principalmente no teste da hipótese de estimativa da máxima verossimilhança através das estatísticas de Wald, LR e LM, do índice de correlação espacial de Moran, e de Geary C (BALTAGI, 2009). Com isso, neste projeto de pesquisa, adotou-se o I de Moran para medir a distribuição espacial do investimento de Taiwan na China Continental nos últimos 20 anos, e é utilizado a matriz em bloco como uma matriz de pesos espaciais.

O modelo de dados do painel espacial é dividido num modelo de lag espacial e num modelo de error espacial. LMerr e LMsar, o seu teste de correlação espacial de forma estável podem fornecer uma visão da definição do modelo, identificar a seletividade do modelo de desfasamento espacial e do modelo de erro espacial. Se LMsar (LMerr) for mais significativo que LMerr (LMsar), então o modelo de atraso espacial (modelo de error espacial) é apropriado (ALVES, 2017). Este estudo obteve LMerr (0,2144) > LMsar (0,0742) com base no resultado, portanto, o modelo de error espacial foi mais apropriado do que o modelo de lag espacial. Com base na correlação espacial global, o modelo autorregressivo espacial mostrou que todas as variáveis explicativas do crescimento econômico de uma região atuam sobre outras áreas através de um mecanismo de transmissão espacial. O modelo de error espacial mostra que o impacto das repercussões regionais é o resultado de choques aleatórios. O modelo adotado de error espacial (SEM) é o seguinte:

O é a variável dependente, é considerado o vetor das variáveis independentes (incluindo um termo constante), é o coeficiente variável, e são coeficientes de autocorrelação espacial e é a componente de erro. No modelo unidimensional de decomposição de erro, ou e no modelo bidimensional de decomposição de erro , , e … sendo considerada a dimensão temporal e a dimensão da secção transversal, respectivamente. é a matriz da unidade T-dimensional, e é a matriz de peso espacial n × n (n é o número de regiões). Com isso, consegue determinar a matriz de pesos espaciais e alguns fatores que podem influenciar nos investimentos de Taiwan para a China Continental.

Este projeto de pesquisa irá utilizar os dados do painel espacial para analisar os padrões de investimento de Taiwan na China. De acordo com a distribuição geográfica do investimento dos taiwaneses com os chineses, publicado pela Comissão de Investimento do Ministério dos Assuntos Económicos de Taiwan, foi escolhida 21 províncias na China Continental que são regiões autônomas, como amostras estatísticas (ALVES, 2017). Estas incluem Heilongjiang, Jilin, Liaoning, Hebei, Beijing, Shanxi, Tianjin, Shandong, Jiangsu, Anhui, Sichuan, Hubei, Chongqing, Shanghai, Zhejiang, Hunan, Jiangxi, Yunnan, Fujian, Guangdong, e Guangxi. O algoritmo K-nearest neighbor (KNN), como variável independente, foi utilizado para estimar os resultados do teste do índice de Moran, tendo como base a matriz de peso espacial, citada anteriormente (TABELA 10).

Tabela 10: Fatores de impacto regional do investimento de Taiwan na China Continental

| Variáveis independentes | Abr. | |

| Ambiente de Investimentos | Geografia | ENVI |

| Infraestrutura | INFR | |

| Ambiental Social | SOEN | |

| Ambiente Legal | LAWE | |

| Ambiente Econômico | ECEN | |

| Ambiente de Mercado | MARKE | |

| Ambiente de Inovação | INEN | |

| Risco Social | SORI | |

| Riscos de Investimentos | Risco Legal | LARI |

| Risco Operacional | MARI | |

| Risco Econômico | ECRI | |

| O grau de apreciação de Taiwan | O grau de preferência de investimentos em Taiwan | RECO |

Fonte: Adaptado pelo autor.

De acordo com o relatório TEEMA de Taiwan, publicado anualmente, os fatores que afetaram os investimentos de Taiwan na China Continental em 2008, 2009 e 2010 incluíram doze índices (TABELA 10): geografia, infraestrutura, ambiente social, ambiente legal, ambiente econômico, ambiente de mercado ou business, ambiente de inovação, risco social, risco legal, risco operacional, risco econômico e grau de apreciação de Taiwan, o que significa que o grau de preferência dos empresários de Taiwan gostaria de recomendar a China Continental a outros empresários de Taiwan como regiões de investimento.

Então, os dados foram obtidos por uma avaliação independente dos dados da amostra, e não dos dados econômicos reais, estas variáveis devem ser independentes (TABELA 11) (BALTAGI, 2009). Contudo, os dados obtidos a partir do teste de multicolinearidade do modelo tinham um elevado grau de correlação entre estes índices. Esta característica pode aumentar o erro padrão dos coeficientes de regressão, alterando assim o nível de significância e a direção dos coeficientes e (ALVES, 2017). No entanto, a colinearidade do modelo econométrico não afetaria a dimensão dos coeficientes de regressão. Por conseguinte, é realizado um teste de colinearidade para voltar a analisar as variáveis independentes (GOMES, LIMA, et al., 2019). Podem ser obtidos coeficientes de regressão significativos, que mostram as características das correlações.

Tabela 11: Teste do índice Moran para as províncias (1992-2010)

| Anos | Moran | E(I) | Z | P |

| 1991 | 0.1848 | -0.0500 | 2.3133 | 0.0290 |

| 1992 | 0.0518 | -0.0500 | 1.5217 | 0.0760 |

| 1993 | 0.1336 | -0.0500 | 1.9165 | 0.0560 |

| 1994 | 0.1663 | -0.0500 | 1.8711 | 0.0470 |

| 1995 | 0.1531 | -0.0500 | 1.6580 | 0.0680 |

| 1996 | 0.0992 | -0.0500 | 1.2300 | 0.0900 |

| 1997 | 0.0836 | -0.0500 | 1.5321 | 0.0780 |

| 1998 | 0.0519 | -0.0500 | 1.0922 | 0.1370 |

| 1999 | 0.0167 | -0.0500 | 0.6624 | 0.2036 |

| 2000 | 0.0064 | -0.0500 | 0.5465 | 0.2250 |

| 2001 | 0.0762 | -0.0500 | 1.1951 | 0.1230 |

| 2002 | 0.1675 | -0.0500 | 1.9454 | 0.0550 |

| 2003 | 0.1228 | -0.0500 | 1.5897 | 0.0810 |

| 2004 | 0.2012 | -0.0500 | 2.3281 | 0.0310 |

| 2005 | 0.1659 | -0.0500 | 2.1419 | 0.0320 |

| 2006 | 0.1166 | -0.0500 | 1.7463 | 0.0670 |

| 2007 | 0.1216 | -0.0500 | 1.7386 | 0.0630 |

| 2008 | 0.1417 | -0.0500 | 2.2606 | 0.0240 |

| 2009 | 0.1300 | -0.0500 | 1.9956 | 0.0400 |

| 2010 | 0.1012 | -0.0500 | 1.6154 | 0.0700 |

Fonte: Adaptado pelo autor.

No total dos 20 anos de investimento regional de Taiwan na China Continental mostram as características de uma correlação espacial positiva. Os dados de 1991, 2004, 2005, 2008, e 2009 foram significativos ao nível de 5%; 1993, 1994, 2002, 2006, e 2007 foram significativos ao nível de 10%. A correlação positiva para os outros anos não foi significativa (TABELA 11).

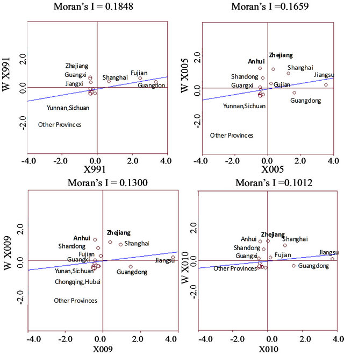

É visto que, 1991, 2005, e 2009 como anos com características significativas de concentração espacial, bem como 2010 (ano em que foi assinado o Economic Cooperation Framework Agreement (ECFA)). E mesmo assim, tendo uma correlação positiva não significativa, algumas outras regiões apresentam melhores resultados. A região do Delta do Rio das Pérolas tornou-se a principal região de investimento de Taiwan. Fujian, Guangdong, e Xangai são as três principais áreas de investimento e representam, na sua maioria, indústrias de mão-de-obra intensiva (FIGURA 7). O investimento de Taiwan nestas três regiões mostra uma correlação positiva com o espaço (primeiro quadrante).

Figura 7: Gráficos de correlação espacial do índice global Moran’s I

Fonte: Adaptado pelo autor.

O investimento de Taiwan foi baixo nas regiões de Guangxi, Jiangxi, Zhejiang, e as distribuições geoespaciais precisas foram positivamente correlacionadas com estas três regiões. O investimento de Taiwan nas restantes províncias foi relativamente pequeno. Em 2005, o padrão de investimento de Taiwan na China tinha-se alterado (FIGURA 7). Havia correlações espaciais positivas significativas entre Jiangsu, Xangai, Zhejiang, e Fujian. Guangdong, com um grande volume de investimento de Taiwan, mostrou uma correlação negativa com as províncias circundantes e um pequeno investimento de Taiwan. Shandong, Anhui, e Guangxi tiveram pouco investimento em Taiwan e apresentaram uma correlação espacial negativa (BALTAGI, 2009).

As restantes províncias que têm um baixo investimento de Taiwan, mostraram uma correlação espacial positiva. Em 2009, Jiangsu, Xangai, e Zhejiang mostraram características espaciais positivas. Shandong, Anhui, e Fujian apresentaram uma correlação espacial negativa. Guangdong, uma província com um forte investimento de Taiwan, apresentou uma correlação negativa com as áreas circundantes (BALTAGI, 2009). No entanto, Guangxi mostrou uma forte independência espacial. Em 2010, a heterogeneidade espacial do investimento de Taiwan na China não foi significativa, enquanto a distribuição espacial dos investimentos foi homogênea.

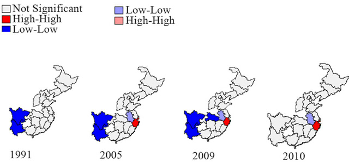

O gráfico de concentração espacial do Índice Local de Associação Espacial (LISA) medido utilizando o índice Moran, mostra que a distribuição da região investida de Taiwan desde 1991 e tem duas características significativas (FIGURA 8). Primeiramente, foi indicada uma correlação positiva significativa entre áreas de baixo valor em Sichuan (nível de 1%) e Yunnan (5%). A correlação espacial das restantes províncias não foi significativa. Em 2005, a província de Anhui e as áreas circundantes apresentaram uma correlação negativa significativa (1%). Zhejiang e as regiões limítrofes mostraram uma correlação positiva ao nível de 5%. Sichuan e Yunnan mostraram uma baixa correlação positiva ao nível de 5%. Em 2009, as províncias que mostraram uma correlação positiva de baixo valor (5%) foram Yunnan, Sichuan, Hubei e Chongqing. A província de Anhui mostrou uma correlação negativa ao nível de 5%, e a província de Zhejiang mostrou uma correlação positiva de 5%. Em 2010, a província de Anhui mostrou uma correlação negativa de baixo – ao nível de 5%, enquanto Zhejiang mostrou uma correlação positiva de alto valor – ao nível de 5%. A correlação espacial das restantes províncias não foram significativas (BALTAGI, 2009).

Figura 8: A concentração espacial do índice Moran

Fonte: Adaptado pelo autor.

Assim, o investimento de Taiwan na China nos últimos 20 anos foi o mais elevado na província de Zhejiang, que tinha a correlação espacial mais forte e a maior homogeneidade com as áreas circundantes, enquanto a província de Anhui e as suas áreas circundantes mostraram uma heterogeneidade espacial pouco significativa. O padrão de investimento dos taiwaneses na China Continental apresenta polarização e a falta de um mecanismo de cooperação inter-regional apropriado, o que resultou na fraca correlação espacial entre regiões (ALVES, 2017). A distribuição inter-regional do investimento de Taiwan não resultou numa situação de desenvolvimento mais interativo entre ambos os lados do Estreito (YEUNG, GAN e JIANG, 2022).

E dentro desse padrão dos investimentos taiwaneses da China, têm-se os principais setores que foram impactados pela mudança de postura estratégica da ilha (YEUNG, GAN e JIANG, 2022). Os resultados mostram que as diferenças regionais não foram tidas em conta, e os fatores mais importantes no investimento de Taiwan na China Continental nos últimos três anos (2007, 2008 e 2010) são a melhoria do ambiente natural, infraestruturas, e risco económico (TABELA 12) (ALVES, 2017).

Tabela 12: Resultados da análise geral do modelo de painel

| Variáveis | Coeficiente | Std. Error | t- Statistic | Prob. |

| ENVI | 0.437815 | 0.465588 | 0.940349 | 0.0372 |

| INFR | -1.134638 | 0.601653 | -1.885869 | 0.0595 |

| SOEN | 2.189960 | 0.485041 | 4.514996 | 0.0000 |

| LAWE | -6.714128 | 0.597710 | -11.23308 | 0.0000 |

| ECEN | 4.732710 | 0.400019 | 11.83122 | 0.0000 |

| MARKE | 8.004338 | 0.634303 | 12.61315 | 0.0000 |

| INEN | -0.831210 | 0.417115 | -1.992758 | 0.0465 |

| SORI | 2.888208 | 0.534176 | 5.406851 | 0.0000 |

| LARI | -6.854205 | 0.750625 | -9.131328 | 0.0000 |

| MARI | 4.887199 | 0.805937 | 6.063994 | 0.0000 |

| ECRI | 0.001636 | 0.739322 | 0.002213 | 0.0982 |

| RECO | -3.817749 | 0.426538 | -8.950542 | 0.0000 |

| R² | 0.386220 | Média dependente var | 11.79129 | |

| R² Ajustado | 0.381071 | S.D. dependente var | 1.806638 | |

| Regressão de S.E. | 1.421319 | Soma residual dos R² | 2648.415 | |

| Teste de Durbin Watson | 1.393557 | Second Stage SSR | 2648.415 | |

| Rank do Instrumento | 13.00000 | |||

Fonte: Adaptado pelo autor.

Os resultados indicam que algumas variáveis afetaram significativamente o investimento de Taiwan no mercado chinês ao nível de 5%. Entre estes fatores, o ambiente social, o ambiente econômico, e o ambiente de mercado tiveram impactos significativamente positivos. O ambiente legal e o ambiente de inovação tiveram impactos significativamente negativos. O risco social e de mercado tiveram impactos significativamente positivos sobre o investimento em Taiwan. O risco legal teve um impacto significativamente negativo. O grau de preferência por Taiwan teve um impacto significativamente negativo. Pode-se concluir destes resultados que os fatores que efetivamente promoveram o investimento de Taiwan na China Continental nos últimos 3 anos incluem principalmente o ambiente social, o ambiente económico, o ambiente de mercado, e o menor risco legal.

E os resultados apresentados modelo econométrico de erro espacial de efeito fixo (SEM), mostram que as 21 áreas amostradas que receberam investimento de Taiwan em 2008, 2009 e 2010 tiveram efeitos tanto no modelo 2 de efeitos fixos espaciais e no modelo 3 em efeitos fixos temporais (TABELA 13). O ambiente geográfico e o ambiente de mercado mostraram uma relação positiva significativa com o investimento de Taiwan ao nível de 1%; as infraestruturas e o ambiente legal mostraram uma correlação negativa significativa ao nível de 1%; o risco empresarial (business) e o grau de apreciação dos empresários de Taiwan mostraram uma correlação negativa significativa ao nível de 5%.

Tabela 13: Modelo de erro espacial de efeito fixo (SEM)

| Variáveis | Coeficientes | |||

| Modelo 1 | Modelo 2 | Modelo 3 | Modelo 4 | |

| Intercepto | 11.7995 | |||

| ENVI | 1.3662 | 2.441638*** | 1.947974 | 2.946701*** |

| INFR | -2.1184 | -4.711658*** | -2.075676 | -5.252975*** |

| SOEN | 3.0410 | 1.912495* | 3.760813* | 1.856820* |

| LAWE | -7.4177*** | -4.003429*** | -8.309495*** | -4.377563*** |

| ECEN | 4.5272** | 0.969862 | 4.874697*** | 0.843587 |

| MARKE | 7.1753** | 4.465349*** | 6.916222** | 5.001891*** |

| INEN | -1.2589 | -2.188730** | -1.527832 | -2.250578** |

| SORI | 1.7089 | 0.783276 | 1.417288 | 1.431297 |

| LARI | -6.6332** | -0.882737 | -7.455075** | -0.703268 |

| MARI | 3.3069 | -4.182716* | 3.404127 | -5.666034** |

| ECRI | 0.6318 | 1.579397 | 1.568447 | 2.009705 |

| RECO | -4.4494** | -1.883895** | -4.853772** | -2.048145** |

| Spat.aut. | -0.1790 | -0.210969 | -0.233976* | -0.312971** |

| R | 0.4145 | 0.9296 | 0.4075 | 0.9289 |

| F | -110.08523 | -43.476101 | -110.68627 | -44.30271 |

| Total Time | 0.4810 | 0.1220 | 0.0970 | 0.1140 |

Nota: *p < 0,1; **p < 0,05; ***p < 0,01. Modelo 1: Sem efeitos fixos; Modelo 2: Efeitos fixos espaciais; Modelo 3: Efeitos fixos temporais; Modelo 4: Efeitos fixos espaciais e temporais.

Fonte: Adaptado pelo autor.

Os resultados do modelo de erro espacial (SEM) mostraram que a diferença nos ambientes geográficos, de mercado inter-regionais e a melhoria gradual em cada região desses dois fatores, tiveram um impacto positivo significativo nos investimentos de Taiwan na China Continental nos últimos três anos (2008, 2009 e 2010).

A diferença na infraestrutura inter-regional e no ambiente jurídico restringiu significativamente a estratégia de investimento regional de Taiwan. Os resultados do modelo 4 indicam que os riscos comerciais e o grau de apreciação dos empresários taiwaneses mais significativamente (nível de 5%) restringiram a estratégia de escolha do investimento taiwanês na China Continental. Se as diferenças regionais não fossem levadas em consideração, dos fatores mais importantes relativos aos investimentos de Taiwan na China Continental nos últimos três anos, o ambiente social, o ambiente econômico, o ambiente de mercado, o risco social e o risco de mercado poderiam ter maiores impactos significativamente positivos. O ambiente legal, o ambiente de inovação, o risco legal e o grau de apreciação dos empresários taiwaneses tiveram impactos negativos significativos sobre o investimento em Taiwan.

De forma simples, os principais eventos políticos de Taiwan afetaram a conveniência do investimento na China, e um governo mais democrático voltou ao poder, o que reduziu gradualmente a mensagem positiva que era favorável à interação econômica entre as duas margens do Estreito (MA, 2021). Também afetou e mudou a confiança, as estratégias comportamentais e a distribuição regional dos investimentos de Taiwan na China Continental.

E o questionamento que fica é se mesmo com algumas áreas ou regiões chinesas que Taiwan possam estar investindo mais, outras com reduções de investimentos, a China com um maior comportamento hostil com os taiwaneses, por crerem que são soberanos no Estreito, é se realmente a China irá invadir Taiwan e se os americanos irão proteger os taiwaneses? E o que pode ser mais importante nesse conflito, é o lado político ou econômico? Visto que Taiwan está muito associado economicamente à China e os Estados Unidos, e como foi mostrado, que ao longo dos últimos 20 anos, vem reduzindo seus investimentos na China Continental (PIETRAFESA e SILVA, 2019) e (MA, 2021).

3 A China irá invadir Taiwan? Os americanos irão proteger a ilha? Nesse conflito irá sobressair política ou economia?

Depois de toda a discussão qualitativa e estatística, é visto que a China está cada vez mais perto de ter uma ofensiva contra Taiwan. E partir disso, é possível elaborar 6 tópicos das motivações chinesas em caso de invasão a ilha:

1 – Ocidentalização taiwanesa

Como já foi abordado, a relação entre Taipei e Pequim já estão em um clima muito tenso e hostil, desde eleição da Presidente Tsai Ing-wen, em janeiro de 2016 (HERNÁNDEZ, 2016; TRENT, 2020). Assim, Xi Jinping ver o novo governo democrático de Taiwan, tendo um maior alinhamento com a política americana e afastamento da política de One China, como uma ameaça para desestabilizar a paz de ambos os lados do Estreito e do sonho de regeneração nacional chinês (SUNG, 2021). Diferente no período do governo de Ma Ying-jeou, que mesmo adotando a política de One China, teve altos índices de compras bélicas com os Estados Unidos (EUA), de certo modo, tentando se modernizar militarmente para se proteger da China (TABELA 2 e 6) (PIETRAFESA e SILVA, 2019).

2 – Modernização militar de Taiwan

Então, uma forma também de continuar ameaçando o sonho chinês é a contínua exportação de armas dos EUA para Taiwan, fazendo com que o sentimento da sociedade que já se considerava independente da China, amplie o desejo de estabelecer sua soberania na região. E possivelmente sendo uma forma de os taiwaneses não sentirem medo da ameaça chinesa, visto que podem tentar retaliar em caso de uma ameaça maior no Estreito (TABELA 6) (CARVAJAL, PRAJ e STROBEL, 2020). Ou seja, é uma forma de ser contrária a política de regeneração nacional chinesa.

3 – Presidente Tsai, contrária a política de One e Dream China, ou seja, do sonho de regeneração nacional

A Presidente Tsai, é conhecida por recusar a política de One China e se recusa a reconhecer o Consenso de 1992, que salvaguarda que tanto Taiwan como o continente anuem fazer parte de “uma só China”. Tsai ainda afirma que os taiwaneses já devem ser considerados um Estado independente, logo, não precisa de declarar formalmente a sua independência. (TIAN e LEE, 2020). E esse seu desejo de ser soberano no sistema internacional e buscar maiores reconhecimentos dos países, é um alinhamento com os pensamentos dos cidadãos de Taiwan. Onde, 72,7% da população, não concordam com a política de que ambos os lados do Estreito pertencem a “uma só China” (CHAI e HUANG, 2016). E outro fator no seu governo é ampliar o acesso americano na ilha. Por exemplo, do entre 2020 e 2022, servidores do mais alto escalão dos EUA visitaram a ilha do que nas quatro décadas anteriores, para demonstrar forte apoio ao governo democrático de Taiwan, incluindo o subsecretário de Estado, Keith Krach, secretário de saúde, Alex Azar e a presidente da câmara dos deputados, Nancy Pelosi (SUNG, 2021). E isso evidencia uma maior afinidade de Taiwan ou de Tsai com o governo de Joe Biden, o que enfurece o Xi Jinping, que já discursou que não tem possibilidade da ilha ser independente (HERNÁNDEZ, 2016; SOUSA, 2022).

4 – Apoio do Ocidente à Taiwan

Com isso, a primeira prioridade dos americanos em caso de invasão chinesa é apoiar Taiwan, como já vem correndo nas últimas décadas (BECKLEY, 2020). Os exemplos mais claros desse apoio do Ocidente, é a modernização militar, maior inserção nos assuntos internacionais de Taiwan e discursos públicos de apoio para os taiwaneses contra a agressão chinesa. Claro que se a China tomasse Taiwan, a China poderia libertaria dezenas de navios, centenas de lançadores de mísseis e aviões de combate para se proteger mais contra a possível invasão americana para tentar retomar ilha, dessa forma, escalando muito mais o custo da guerra (BECKLEY e BRANDS, 2021). Podendo desencorajar os EUA a defender Taiwan, mesmo que Joe Biden, declare forte apoio militar à ilha em caso de invasão chinesa (HAKIM, 2021). E os EUA poderiam perder muito no acesso à principal indústria de semicondutores do mundo, que está localizada em Taiwan (BECKLEY e BRANDS, 2021). A perca econômica dos EUA sobre a ilha, faz com que esse lado político das tensões dos países, seja espelhado também no lado da economia (HSU, HSU e HE, 2021).

5 – Redução (%) da China na economia de Taiwan

Taiwan junto com o apoio americano vem tentando elevar seu share (%) no mercado internacional, mas ainda o seu comércio depende muito da China, sendo seu principal parceiro comercial (MA, 2021). Com a não adoção da política One China por Tsai, também pode-se perceber que Taiwan quer tentar, aos poucos, desvincular a sua economia da China. Por exemplo, têm-se uma redução de 1,49% entre 2017 até 2019, do share (%) chinês no mercado taiwanês (TABELA 3). Mesmo sendo um valor “simbólico”, existe um padrão, mesmo que entre 2000-2008, a china tenha ampliado seu poderio econômico na ilha de em 445,73%, depois disso, é visto uma maior estabilidade do acesso chinês à economia dos taiwaneses e no governo do Xi Jinping, não crescendo no mesmo nível, mantendo sempre um grau próximo de 20% (PIETRAFESA e SILVA, 2019). Ou seja, de certo modo, Taiwan está tentando não ser mais tão dependente do mercado chinês.

Ainda focando no comercio internacional dos ambos os lados do Estreito, é percebido problemas sobre a tarifa de importação. O Acordo Association of Southeast Asian Nations (ASEAN), eliminaria as tarifas de importações dos países do Acordo para a China, em 90% dos produtos comercializados (FEDDERSEN, 2020). Como Taiwan é uns dos únicos países da Ásia que não faz parte do acordo, para Krugman (2015), a ilha sofrerá de perca de bem-estar, altos custos de produção, perca de competitividade de exportação, consequentemente prejudicando o comércio de semicondutores do país (FIGURA 6). Em resposta as adversidades que os taiwaneses vêm sofrendo, é também visto diminuições dos investimentos de Taiwan na China Continental.

6 – Redução dos investimentos de Taiwan no comércio chinês

Os investimentos de Taiwan na China Continental e os riscos comerciais estão negativamente correlacionados, indicando que os investimentos de Taiwan na China Continental foram afetados pelas relações econômicas ou políticas gerais entre os dois países, especialmente em Taiwan nos últimos anos (ALVES, 2017). Ou seja, as tensões entre os países sendo políticas ou econômicas, também afetaram e mudaram as estratégias comportamentais e a distribuição regional dos investimentos de Taiwan no comércio chinês. O que pode significar que ambos os lados do Estreito, tem tensões muito elevadas, que afetam no lado político e econômico, seja na região ou com o resto do mundo (FEDDERSEN, 2020).

Por fim, com esses tópicos analisados, ainda assim, é difícil estimar que a curto prazo Taiwan seja invadida, pois a China tem muito mais a perder do que a ganhar com um eventual conflito. Por exemplo, como seu comércio também está fortemente associado com Japão ou Coreia, no continente asiático, pode ser percebido que como esses países têm ampla influência Ocidental, podem tentar retaliar com o mercado chinês, ocasionando dificuldades econômicas interna para China (FEDDERSEN, 2020). Ou até mesmo dos americanos realizarem uma cooperação militar de Estados com políticas Ocidentais na Ásia para impedir o avanço chinês sobre Taiwan, fazendo com que, ainda mais, os custos de uma guerra contra a ilha se elevem (TIAN e LEE, 2020). Ou seja, ainda é difícil prever que Xi Jinping irá fazer uma guerra contra os taiwaneses, essencialmente pelos custos escalonarem, que já vem ocorrendo pela política de covid zero, de maneira, que fique muito mais difícil de retomar Taiwan à força. (TIAN e LEE; FEDDERSEN, 2020).

Mas, é fato que o líder do PCC vem tendo posturas mais agressivas com a ilha, e como a doutrina do Estado chinês é a utilização da força (BURKITT, SCOBEL e WORTZEL, 2003). Pode ser que se Taiwan continuar com a política de Tsai, nos próximos períodos, é possível que os chineses não tenham outra escola, de não ser, invadir e tomar a força Taiwan.

4 Considerações finais

Neste projeto de pesquisa foi examinado os níveis de tensões, tanto no âmbito de segurança, econômico e econométrico entre Estados Unidos, China e Taiwan.

Os estudos empíricos mostraram resultados divergentes sobre esse tema. Os resultados do projeto mostraram que claramente os Estados Unidos (EUA) desde o governo Obama, mantém uma política de alinhamento duplo com ambos os lados do Estreito de Taiwan. Além da China estar motivada de usar a força para alcançar a reunificação com Taiwan, caso continue ainda mais adentrando na política ocidental (HUANG, 2017).

Estas observações têm implicações importantes da ofensiva chinesa para região e para os Estados Unidos. O contínuo compromisso dos EUA com a segurança de Taiwan e, em particular, a continuidade das vendas de armas para Taiwan, representa uma das principais fontes de tensão no relacionamento sino-americano mais amplo. Nos últimos anos, analistas tanto em Washington quanto em Pequim propuseram novas abordagens para a questão (HAASS e SACKS, 2020). Nos Estados Unidos, alguns sugeriram que o país acabasse com as vendas de armas a Taiwan e considerassem recuar em seu compromisso com a ilha de forma mais ampla. Na RPC, alguns têm sugerido que uma China em ascensão adote uma linha mais dura em resposta às vendas de armas dos EUA (HAASS e SACKS, 2020).

Claro que no projeto é visto que ambas as alterações políticas propostas acarretam riscos significativos. No caso dos EUA, o fim das vendas de armas ou de relações entre o comércio para Taiwan poderia contribuir para um aumento da probabilidade de conflito no Estreito, ajudando a mudar as relações entre os dois lados do Estreito de uma dinâmica de dissuasão para uma dinâmica de competência (LEE e SIU, 2019). No caso chinês, uma abordagem mais dura das vendas de armas e comercial dos EUA poderia ter um efeito contrário, revelando um compromisso mais forte dos EUA com a segurança de Taiwan do que se poderia supor atualmente (PANDA, 2019).

Em outras palavras, cada vez mais a aproximação de Taiwan com os Estados Unidos (Ocidente), enfurece os chineses, que tentam isolar a ilha do resto do mundo (WENZHAO, 2017). Já que o sonho de regeneração nacional envolve a unificação com a ilha e que nenhum poder irá separar ambos os lados do Estreito (SILK, 2013; XINHUA, 2014).

Por fim, o projeto da pesquisa mostra que embora os Estados Unidos estejam tentando inserir Taiwan em mais participações nos assuntos internacionais, sendo política, segurança ou comércio (WANG, 2020). A China, se mantem inalterada sobre esse comportamento e pensa na ofensiva contra a ilha rebelde, pois para alcançar o sonho chinês, primeiramente se deve ter a reunificação com a sociedade rebelde, ou seja, Taiwan (HUANG, 2017).

5 Bibliografia

ALVES, Denisard. ML E TESTES WALD, LM E RAZÃO DE ML, São Paulo, 2017. Disponível em: <https://edisciplinas.usp.br/pluginfile.php/3465973/mod_resource/content/1/ML%20E%20TESTES%20WALDFont18.pdf>. Acesso em: 18 Dezembro 2022.

ALVES, Rafael Q.; PASSOS, Rodrigo D. F. D. A HEGEMONIA INTERNACIONAL DA REPÚBLICA POPULAR DA CHINA SOB O GOVERNO DE XI JINPING: UMA ANÁLISE DA BUSCA PELA CONCRETIZAÇÃO DO SISTEMA TIANXIA A PARTIR DO REALISMO OFENSIVO, Marília, XVII, n. 1, 2017. 39-50. Disponível em: <https://revistas.marilia.unesp.br/index.php/ric/article/view/9876>. Acesso em: 4 Dezembro 2022.

BALTAGI, Badi H. The Wald, LR, and LM Inequality, 11 Fevereiro 2009. Disponível em: <https://www.cambridge.org/core/journals/econometric-theory/article/abs/wald-lr-and-lm-inequality/6D8D6676360F6FA3EC708ADCFAFA6EC9>. Acesso em: 18 Dezembro 2022.

BARBOSA, Vinícius A.; JUNIOR, Augusto W. M. T.; SATUR, Roberto V. Quem se importa com Taiwan?, Paraíba, 2016. 2-12. Disponível em: <http://repositorio.asces.edu.br/handle/123456789/191>. Acesso em: 20 Setembro 2022.

BECKLEY, M. The Emerging Military Balance in East Asia: How China’s Neighbors Can Check Chinese Naval Expansion, XLII, n. 2, 1 Novembro 2017. 78-119. Disponível em: <https://doi.org/10.1162/ISEC_a_00294>. Acesso em: 10 Dezembro 2022.

BECKLEY, Michael. The Emerging Military Balance in East Asia: How China’s Neighbors Can Check Chinese Naval Expansion, XLII, n. 2, 1 Novembro 2017. 78-119. Acesso em: 3 Outubro 2022.

BECKLEY, Michael. China Keeps Inching Closer to Taiwan, 19 Outubro 2020. Disponível em: <https://foreignpolicy.com/2020/10/19/china-keeps-inching-closer-to-taiwan/>. Acesso em: 2 Outubro 2022.

BECKLEY, Michael; BRANDS, Hal. Into the Danger Zone: The Coming Crisis in US-China Relations, 1 Janeiro 2021. Disponível em: <https://www.jstor.org/stable/resrep27632>. Acesso em: 3 Outubro 2022.

BHATTACHARYYA, Suman. An uphill battle’: Why Macy’s is pulling out of China, 7 Dezembro 2018. Disponível em: <https://digiday.com/retail/macys-pulling-out-china/>. Acesso em: 7 Outubro 2022.

BOREAU OF TRADE. VALUE OF EXPORTS & IMPORTS BY COUNTRY, 2022. Disponível em: <https://cuswebo.trade.gov.tw/FSCE040F/FSCE040F>. Acesso em: 5 Outubro 2022.

BURKITT, Laurie; SCOBEL, Andrew; WORTZEL, Larry M. The Lessons Of History: The Chinese People’s Liberation Army At 75.

CARVAJAL, Carolina R.; PRAJ, Dusan; STROBEL, Jorge A. A. La relación triangular entre China, Taiwán y Estados Unidos en el periodo 2008-2018, n. 30, 3 Maio 2020. 92-106. Acesso em: 4 Dezembro 2022.

CHAI, Scarlett; HUANG, Romulo. Most people in Taiwan in favor of cross-strait status quo, 29 Março 2016.

CHOU, Chi-An. A Two-Edged Sword: The Economy Cooperation Framework Agreement Between the Republic of China and the People’s Republic of China, VI, n. 2, 22 Junho 2010. Disponível em: <https://digitalcommons.law.byu.edu/ilmr/vol6/iss2/2/>. Acesso em: 4 Outubro 2022.

CHRISTENSEN, Thomas J. Taiwan’s Legislative Yuan elections and Cross-Strait Security Relations: Reduced tensions and remaining challenges, XIII, 2006. 1-11. Disponível em: <https://www.hoover.org/sites/default/files/uploads/documents/clm13_tc.pdf>. Acesso em: 17 Dezembro 2022.

FEDDERSEN, Gustavo H. As estratégias chinesas para Taiwan e seus impactos securitários no pós-Guerra Fria, Porto Alegre, 2020. 99-107. Disponível em: <https://lume.ufrgs.br/handle/10183/217770>. Acesso em: 4 Outubro 2022.

GOMES, Carlos E. et al. COMÉRCIO INTERNACIONAL E PIB PER CAPITA: UMA ANÁLISE UTILIZANDO A ABORDAGEM ESPACIAL, Paraná, XL, n. 71, 2019. Acesso em: 17 Dezembro 2022.

HAASS, Richard; SACKS, David. American Support for Taiwan Must Be Unambiguous, 2 Setembro 2020. Disponível em: <https://www.foreignaffairs.com/articles/united-states/american-support-taiwan-must-be-unambiguous>. Acesso em: 25 Setembro 2022.

HAKIM, Amri. U.S.-CHINA RIVALRY AND THE NEOSTRUCTURAL REALISM.

HERNÁNDEZ, Javier C. China Suspends Diplomatic Contact With Taiwan, 25 Junho 2016. Disponível em: <https://www.nytimes.com/2016/06/26/world/asia/china-suspends-diplomatic-contact-with-taiwan.html>. Acesso em: Setembro 30 2022.

HSU, Hung-Chi; HSU, Hui-Lin; HE, Mei-Zhen. Research for Maintaining Cross-Strait Peace and Economic Development in the Post-Epidemic Era, 8 Abril 2021. 227-232. Acesso em: 22 Setembro 2022.

HUANG, Jing. 13 Xi Jinping’s Taiwan Policy: Boxing Taiwan In with the One-China Framework, n. 1, 2017. 239-248. Disponível em: <https://www.jstor.org/stable/10.1525/j.ctt1w76wpm.16>. Acesso em: 20 Setembro 2022.

KING, Ian. Hub de chips da Intel de US$ 20 bilhões será o maior do mundo, 21 Janeiro 2022. Disponível em: <https://esportes.yahoo.com/noticias/hub-chips-da-intel-us-204537854.html>. Acesso em: Outubro jul. 2022.

KRUGMAN, Paul R.; OBSTFELD, Maurice; MELITZ, Marc J. Economia Internacional.

LEE, Yimou; SIU, Twinnie. China urges U.S. to block Taiwan leader’s Hawaii stopover, 21 Março 2019. Disponível em: <https://www.reuters.com/article/us-taiwan-china-idUSKCN1R2083>. Acesso em: 30 Setembro 2022.

LUZARDO, Antonio J. R.; FILHO, Rafael M. C.; RUBIM, Igor B. ANÁLISE ESPACIAL EXPLORATÓRIA COM O EMPREGO DO ÍNDICE DE MORAN, Rio de Janeiro, 5 Outubro 2017. Acesso em: 19 Dezembro 2022.

MA, Yihan. Trade balance between mainland China and Taiwan from 2015 to 2020 (in billion U.S. dollars), 20 Outubro 2021. Disponível em: <https://www.statista.com/statistics/1270149/chin-trade-deficit-with-taiwan/>. Acesso em: 4 Outubro 2022.

MA, Yihan. Value of goods imports in Taiwan in 2021, by exporting country or region, 23 Fevereiro 2022. Disponível em: <https://www.statista.com/statistics/324642/taiwan-import-partners-by-country/>. Acesso em: 5 Outubro 2022.

PANDA, Ankit. Taipei Slams ‘Provocative’ Chinese Air Force Fighters Cross Taiwan Strait Median Line, 1 Abril 2019. Disponível em: <https://thediplomat.com/2019/04/taipei-slams-provocative-chinese-air-force-fighters-cross-taiwan-strait-median-line/>. Acesso em: 30 Setembro 2022.

PIETRAFESA, Pedro; SILVA, Amelia G. D. POLITICAL AND ECONOMIC RELATIONS OF STRATEGIC TRIANGLE AMONG CHINA, TAIWAN AND UNITED STATES (1996-2016), Goiás, 28 Novembro 2019. Disponível em: <https://revistas.cefet-rj.br/index.php/producaoedesenvolvimento/article/view/413>. Acesso em: 3 Dezembro 2022.

RATO, Vasco. De Mao a Xi: O Ressurgimento da China.

SILK, Richard. Is Taiwan Part of the ‘Chinese Dream?’, 18 Junho 2013. Disponível em: <https://www.wsj.com/articles/BL-CJB-17888>. Acesso em: 30 Setembro 2022.

SOUSA, Alison C. Relação triangular entre Estados Unidos, Taiwan e China no início de governo do Joe Biden, 13 Outubro 2022. Disponível em: <https://mapamundi.org.br/en/2022/relacao-triangular-entre-estados-unidos-taiwan-e-china-no-inicio-de-governo-do-joe-biden/>. Acesso em: 12 Dezembro 2022.

SUNG, Wen-Ti. TAIWAN’S SEARCH FOR A GRAND STRATEGY, 2021. 209-214. Disponível em: <https://www.jstor.org/stable/j.ctv1m9x316.23>. Acesso em: 1 Outubro 2022.

TADEU, Vinícius. Brasil e 10 países votam por resolução crítica à Rússia na ONU; China se abstém, 25 Fevereiro 2022. Disponível em: <https://www.cnnbrasil.com.br/internacional/brasil-e-10-paises-votam-por-resolucao-critica-a-russia-na-onu-china-se-abstem/>. Acesso em: 6 Outubro 2022.

TIAN, Yew L.; LEE, Yimou. China drops word ‘peaceful’ in latest push for Taiwan ‘reunification’, 21 Maio 2020. Disponível em: <https://www.reuters.com/article/us-china-parliament-taiwan-idUSKBN22Y06S>. Acesso em: 30 Setembro 2022.

TRENT, Mercedes. CHINA’S VIEWS OF REGIONAL SECURITY, 1 Janeiro 2020. 27-34. Disponível em: <https://www.jstor.org/stable/resrep26130.9>. Acesso em: 29 Setembro 2022.

U.S. DEPARTMENT OF STATE. Pronunciamento do presidente Joe Biden em seu discurso sobre o Estado da União conforme proferido, Washington, 1 Março 2022. Disponível em: <https://www.state.gov/translations/portuguese/pronunciamento-do-presidente-joe-biden-em-seu-discurso-sobre-o-estado-da-uniao-conforme-proferido/>. Acesso em: 7 Outubro 2022.

VLADIMIR IVANOV. Rebel island: Is China once again ready to resolve the “Taiwan question” by force?, 19 Abril 2022. Disponível em: <http://www.msk-post.com/in_world/rebel_island_is_china_once_again_ready_to_resolve_the_taiwan_question_by_force33241/>. Acesso em: 6 Outubro 2022.

WANG, Kent. A Peace Agreement Between China and Taiwan?, 5 Setembro 2013. Disponível em: <https://thediplomat.com/2013/09/a-peace-agreement-between-china-and-taiwan/>. Acesso em: 16 Setembro 2022.

WANG, T.Y. Hong Kong National Security Law: The View From Taiwan, 2 Julho 2020. Disponível em: <https://thediplomat.com/2020/07/hong-kong-national-security-law-the-view-from-taiwan/>. Acesso em: 30 Setembro 2022.

WENZHAO, Tao. Taiwan Policy of the Obama Administration, 31 Agosto 2017. Disponível em: <https://www.caifc.org.cn/index.php?m=content&c=index&a=show&catid=22&id=529>. Acesso em: 24 Setembro 2022.

XINHUA. Commentary: Xi takes cross-Strait ties new level, Beijing, 22 Fevereiro 2014. Disponível em: <https://www.derechos.org/peace/china/doc/chntwn3.html>. Acesso em: 24 Setembro 2022.

XINHUA. Xi steadfast on reunification, 27 Setembro 2014. Disponível em: <http://www.china.org.cn/china/2014-09/27/content_33850041.htm>. Acesso em: 25 Setembro 2022.

YEUNG, Jessie; GAN, Nectar; JIANG, Steven. What you need to know about China-Taiwan tensions, 25 Maio 2022. Disponível em: <https://edition.cnn.com/2022/05/24/china/china-taiwan-conflict-explainer-intl-hnk/index.html>. Acesso em: 7 Outubro 2022.

ZANDT, Florian. Who Relies on Taiwanese Trade?, 5 Agosto 2022. Disponível em: <https://www.statista.com/chart/27927/principal-trade-partners-for-taiwan-per-region-by-trade-volume/>. Acesso em: 4 Outubro 2022.

Graduado em Relações Internacionais pela ESPM.