Why Invest Your Money in J-REITs in Japan 2021 Why Invest Your Money in J-REITs in Japan 2,4% (Why Invest Your Money in J-REITs in Japan, 2022), Why Invest Your Money in J-REITs in Japan 2020. Why Invest Your Money in J-REITs in Japan 5 years, Why Invest Your Money in J-REITs in Japan 2020 e 2021 influenced by COVID-19, the tokyo stock exchange index (Nikkei 225) got an increase of 48,5% (RIVAS, 2022). Different in Brazil, the brazilian stock exchange index (Ibovespa) undergoes a reduction of 3,6% in the same period.

Japan is the 3rd largest economy in the world, with a GDP of more than 5,2 trillion dollars in 2021(MINISTRY OF FOREIGN AFFAIRS, 2021). And the country's economy is very stable, despite the great effects of the pandemic on the world stage, Japan has an expected GDP growth of 3,2% in 2022 (INTERNATIONAL FUND MONETARY, 2022).

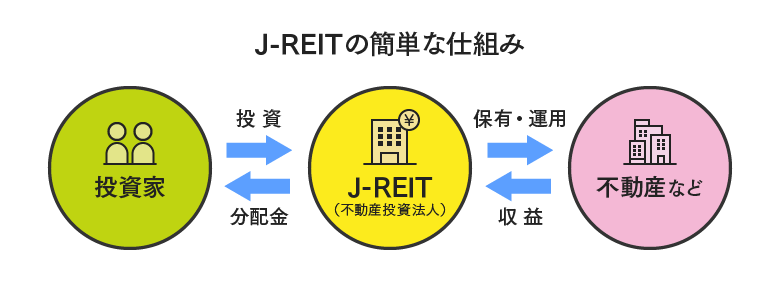

This environment makes Japan very attractive for investments and one of the main highlights in the country are the real estate funds or Real Estate Investment Trust. (J-REITs) that are part of the stock market called in Brazil Real Estate Investment Funds (FIIs). Real estate funds are a simpler way to have an investment in a property, but without having to buy one. It is to become the owner of a “little piece” of that property through a fund.

To take advantage of the opportunities, it is necessary to open an account with a Japanese stockbroker.. For example, you can open a Rakuten account with a value close to 3 thousand yen, it is already possible to invest in real estate funds on the Japanese stock market (RAKUTEN, 2022). J-REITs are shares that are traded on the Tokyo Stock Exchange. (TYO) and most of these properties are concentrated in the greater center of Tokyo or abroad. Both in Brazil and in the Japanese market with an approximate value of 100 reais it is already possible to invest in the funds (RAKUTEN, 2022), but why should you invest in specific J-REITs and not in some real estate funds in the Brazilian market?

between March 2020 up until 2021, Tokyo Stock Exchange's J-REITs index outperformed Topix, rising more than 25% (GOVERNMENT PENSION INVESTMENT FUND, 2021). Unlike the FIIs in Brazil, which in 2020 has a fall of more than 10% and closed in 2021 with a drop of 2,29% (WILTGEN, 2022). Then, J-REITs pay more dividends than corporate shares and are less variable than most shares on the Tokyo Stock Exchange (TYO), being a great alternative to diversify and start your investment portfolio on the Tokyo Stock Exchange(PIMENTEL, 2022). Basically, in the operation of J-REITs, investors buy shares in real estate funds (J-REITs) mostly being semiannually, that is, every 6 months, receive part of the profits from the accumulated funds. And these funds acquire property assets and receive the rents from these properties, which are also distributed through dividends..

there are more than 60 J-REITs in the Japanese Market, but some stand out, like the Nippon Building with a market capitalization of over 1 trillion yen, Japan Real Estate with market capitalization over 845 billion yen and Nomura Master with market capitalization over 730 billion yen(JAPAN REIT, 2022). Nippon Building is a real estate company located in Tokyo and the fund was listed on the country's stock exchange in 10 September 2001 with start-up capital of approx. 50 billion yen(NIPPON BUILDING FUND, 2022).

Comparing one of the largest Japanese market capitalizations, the Nippon Building with the Brazilian Fundo Imobiliário Kinea Price Index (KNIP11), we see that it retracted in almost 10% on the last year, while Nippon rose close to 1% (THOMSON REUTERS, 2022). And watching dividend performance, while the accumulated 31/01/2022 it was from 1,31% from Kinea Indices Prices Real Estate Investment Fund (KNIP11) (INFOMONEY, 2022), Nippon Building has a higher rate of 3.5%(BLOOMBERG, 2022).

Nippon Building (8951T) X Kinea Real Estate Fund Price Index (KNIP11.SA)

data until 01/03/2022.

Source: Thomson Reuters.

The graph shows that the return accumulated in the last year was higher in Nippon Building than in Kinea Indices Prices Real Estate Investment Fund (KNIP11). This is just one of the investment possibilities in Japan, which occupies the second place in the world market of J-REITs with 9,8%, second only to the USA (PIMENTEL, 2020).

In terms of performance, as shown, some J-REITs had attractive short-term cumulative returns, have provided diversification and dividend-based income that is often higher than what can be obtained with other investments. Of course, not all funds are having high returns., both in the Japanese and Brazilian markets, variable income is volatile. However,, some specific funds continue to give high returns and dividends in 2022, as is the case of Nippon Building. Then, before you start investing, it is recommended that the reader learn more about the real estate fund market in Japan. in order to choose the best fund to allocate your money.

Logo, J-REIT is particularly preferred for investment funds for its liquidity or accessibility that adopt acquisition-growth strategies based on specific investment policies and criteria.(NAKAJIMA-MAGEN, 2021). Each fund has its peculiarity and certain legal requirements (such as the requirement to make annual distributions above 90% of distributable profits) that when satisfied J-REITs are exempt from corporate income tax with respect to dividends they distribute to investors (WITHUM, 2020).

Lastly, opportunities are open, because according to Nanette Jacobson, Director of Fixed Income at Wellington Management, during an online event in 2022, at InfoMoney in partnership with XP Investimentos. “Japanese equities are priced lower than developed market equities and there is room for them to continue growing” (RIVAS, 2022).

Bibliography

BLOOMBERG. Nippon Building Fund Inc, Nova York, 2022. Available in: <https://www.bloomberg.com/quote/8951:JP>. Access in: 1 March 2022.

GOOGLE FINANCE. Kinea Indices Prices Real Estate Investment Fund, 9 February 2022. Available in: <https://www.google.com/finance/quote/KNIP11:BVMF?sa = X&ved=2ahUKEwjo7PLlnvP1AhX1ILkGHSDoCHAQ3ecFegQIGRAc&window=1Y>. Access in: 9 February 2022.

GOOGLE FINANCE. Nippon Building Fund Inc., 9 February 2022. Available in: <https://www.google.com/finance/quote/8951:TYO?sa = X&ved = 2ahUKEwi545aLnvP1AhUmHbkGHRYVBF4Q3ecFegQIERAe&window=1Y>. Access in: 9 February 2022.

GOVERNMENT PENSION INVESTMENT FUND. Integrated risk management between J-REITs and traditional assets, Japan, 24 August 2021. 4-5. Available in: <https://www.gpif.go.jp/investment/20210910_workingpaper.pdf>. Access in: 9 February 2022.

Why Invest Your Money in J-REITs in Japan. Real GDP growth (Annual percent change). Washington, D.C.: [s.n.], 2022. Available in: <https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/JPN>. Access in: 28 March 2022.

INFOMONEY. KNIP11 Real Estate Funds, 25 February 2022. Available in: <https://www.infomoney.com.br/cotacoes/b3/fii/fundos-imobiliarios-knip11/>. Access in: 1 March 2022.

INTERNATIONAL FUND MONETARY. Real GDP growth, USA, 2022. Available in: <https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/JPN/BRA>. Access in: 7 February 2022.

JAPAN REIT. List of Yields, 9 February 2022. Available in: <https://en.japan-reit.com/list/rimawari/>. Access in: 9 February 2022.

MINISTRY OF FOREIGN AFFAIRS. As 15 world's biggest economies, Brasilia, 11 November 2021. Available in: <https://www.gov.br/funag/pt-br/ipri/publicacoes/estatisticas/as-15-maiores-economias-do-mundo>. Access in: 7 February 2022.

NAKAJIMA-MAGEN, WITH. J-REITS (Japanese Real Estate Investment Trusts), Japan, 31 March 2021. Available in: <https://www.linkedin.com/pulse/j-reits-japanese-real-estate-investment-trusts-ziv-nakajima-magen/>. Access in: 25 February 2022.

NIPPON BUILDING FUND. Corporate Overview – Profile and History., Tokyo, 2022. Available in: <https://www.nbf-m.com/nbf_e/profile/company/outline.html>. Access in: 25 February 2022.

PIMENTEL, M. S. J-REITs: Japanese Real Estate Investment Trusts, 2020. Available in: <https://investidornojapao.com/j-reits-japanese-real-estate-investment-trusts/>. Access in: 9 February 2022.

PIMENTEL, M. S. Invest in Real Estate Funds in Japan, 2022. Available in: <https://investidornojapao.com/invista-em-fundos-imobiliarios-no-japao-j-reits-curso-presencial/#:~:text = Os% 20REITs% 2C% 20em% 20m% C3% A9dia% 2C% 20pagam,de% 20se% 20investir% 20em% 20im% C3% B3veis.>. Access in: 25 February 2022.

PIMENTEL, M. S. The 10 REITs with the highest dividend returns in Japan, 2022. Available in: <https://investidornojapao.com/os-10-reits-com-os-maiores-retornos-em-dividendos-do-japao/#:~:text = Os% 20REITS% 20no% 20Jap% C3% A3o% 20pagam,listed na Bolsa de Values.>. Access in: 1 March 2022.

RAKUTEN. Investment Trust Super Search, Japan, 2022. Available in: <https://www.rakuten-sec.co.jp/web/fund/find/search/result.html>. Access in: 7 February 2022.

RAKUTEN. Investment Trust Super Search, Tokyo, 2022. Available in: <https://www.rakuten-sec.co.jp/web/fund/find/search/result.html>. Access in: 2 March 2022.

RIVAS, K. Japan, China or Europe? Know which other markets offer opportunities to diversify investments, Sao Paulo, 21 Janeiro 2022. Available in: <https://www.infomoney.com.br/onde-investir/japao-china-ou-europa-saiba-que-outros-mercados-oferecem-oportunidades-para-diversificar-os-investimentos/>. Access in: 7 February 2022.

RIVAS, K. Market forgotten by investors, Japan is American manager Wellington's bet to 2022, 20 Janeiro 2022. Available in: <https://www.infomoney.com.br/onde-investir/mercado-esquecido-pelos-investidores-japao-e-aposta-da-gestora-americana-wellington-para-2022/>. Access in: 23 February 2022.

THOMSON REUTERS. Nippon Building Fund Inc.8951.T, 2022. Available in: <https://www.reuters.com/companies/8951.T/charts>. Access in: 1 March 2022.

LOOK, E. Japanese REITs Better Than Traditional Assets, GPIF Report Says, 13 September 2021. Available in: <https://www.bloomberg.com/news/articles/2021-09-13/japanese-reits-better-than-traditional-assets-gpif-report-says>. Access in: 10 February 2022.

WILTGEN, J. Paper funds dominate the ranking of the best real estate funds in 2021; also know the worst FII of the year, 2 Janeiro 2022. Available in: <https://www.seudinheiro.com/2022/bolsa-dolar/fundos-de-papel-dominam-o-ranking-dos-melhores-fundos-imobiliarios-de-2021/>. Access in: 9 February 2022.

WITHUM. REITs Come Out Ahead in Light of TCJA, 6 Janeiro 2020. Available in: <https://www.withum.com/resources/reits-come-out-ahead-in-light-of-tcja/>. Access in: 10 February 2022.

Article written by Alison Cordeiro Sousa: student of the International Relations course and researcher at the Nucleus of Asian Business Studies (NENA).